Six months ago, Maura Shaughnessy couldn't find a single utilities company to buy. Back then, these businesses were on a tear—the S&P 500 Utilities sub-index was up 26 percent in 2014—which made it difficult to find undervalued opportunities.

Things have cooled off dramatically since.

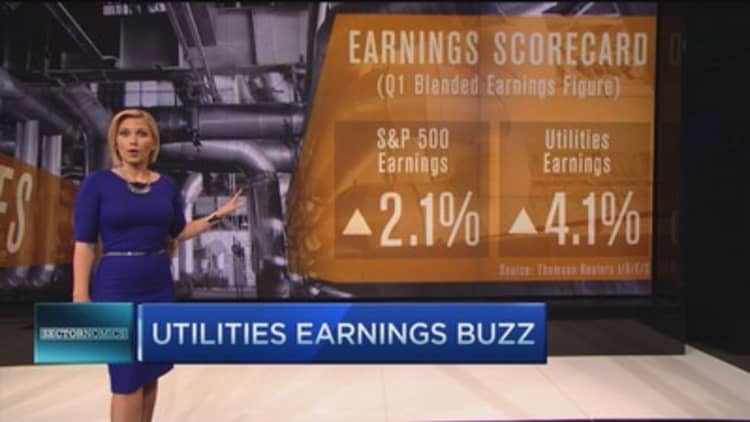

The sector is down about 7 percent year-to-date, while its price-to-earnings valuations have dipped from about 18 times next year's earnings to 16 times. That's meant that Shaughnessy, manager of MFS Investment Management's Utilities Fund, is seeing some opportunities again. The sector closed out last week as the top-returning sector on Friday, up more than 1 percent on a flat day for the markets.

"It's a lot more interesting now," she said.

For years, the utilities industry has been one of the more steady and reliable sectors for investors to buy into—everyone needs power—and regulated utilities are generally allowed to increase their rates every year. Add attractive yields of between 2 percent and 4 percent and you have a sector that would make nearly every type of investor happy.

However, as interest-rate talks have heated up, the sector has become more volatile than usual because utilities is one of the more rate-sensitive sectors.

When bond yields rise and become more attractive from an income standpoint, these stocks fall and vice versa. The idea is that investors would rather own a higher-paying fixed-income product than an equity with a similar yield.

Taken for an interest-rate ride

For the last three years, interest-rate hysteria has come and gone. The Fed's messaging on the end of quantitative easing worked better than its ongoing deliberations over when to finally raise short-term rates again.

In 2013, utility stocks jumped by 16 percent in four months and then fell 12 percent over the following two months as long-term bond yields began to rise. The sector bounced around until the end of the year.

Shaughnessy said this year's decline can be chalked up to two things: a retreat from last year's gains and probably the loudest interest rate-related chatter since the recession.

It's impossible to know when Janet Yellen will make a move. Some people say June, more say September, and there's even a growing chorus to push back the first Fed rate hike since the recession to 2016.

The MFS manager doesn't get involved in the rate prediction game. "There have been so many head fakes from the Fed," she said. However, a lot of people do base their buys on potential rate moves, and that's presented an opportunity, Shaughnessy said. She's focused on finding undervalued companies relative to the company's history, growth prospects and its peers.

The markets are crazy, and there have been various macro freak shows. But you have to buy into those freak shows—that's when the opportunity presents itself.Maura ShaughnessyMFS Investment Management utilities fund manager

While it might be a stretch to say that utilities are a value play right now, Bobby Edemeka, a portfolio manager with Jennison Associates, said that risk-reward trade-off "looks pretty favorable."

Over the last decade—excluding 2008 and 2009—the utilities sector has traded at a 4 percent premium to the S&P 500. Now, though, the sector is trading at about a 2 percent discount to the benchmark, Edemeka said.

"That's in the range of being a fair multiple," he said. "The downside, on a multiple basis, seems fairly limited, and utilities are trading at a reasonable range relative to the S&P 500 and relative to corporate bonds."

Read MoreHow to profit in financial stocks as rates rise

It is possible that returns could fall further when rates do actually rise, but Edemeka thinks that a potential hike is priced into these stocks right now. He also points out that the sector has fallen harder than other interest-rate-sensitive sectors. The S&P 500 real estate investment trusts sub-index, for example, has only fallen by about 3.8 percent this year. That suggests that other sectors could be impacted to a greater degree when the Fed actually makes its move.

Regulated vs. non-regulated

Even if stock prices decline further, there is long-term potential in this sector. Mike Liss, a senior portfolio manager with American Century, is less bullish on the sector than his peers—it's still too overvalued for his liking—but he does own some regulated utilities in his funds.

He likes regulated companies because they're more stable and predictable than non-regulated ones. When regulated companies do poorly, they can go to the state and say they need a rate increase, which officials tend to grant. These companies also produce a high single-digit return on equity, and because of the stability in rates, yields are generally safe.

Two companies he likes today are Pacific Gas and Electric Company and Westar Energy, in part because they're less expensive than other utilities stocks.

However, it's important to keep in mind that regulated utilities don't grow as quickly as non-regulated ones, Liss said.

"That goes back to a philosophical question," he said. "If stocks are (fair or overvalued), but they grow less than the average company, should I be paying a market multiple for the stock, or do I need a discount? I like the discount if I'm going to buy a slower grower."

For Shaughnessy and Edemeka, there's more opportunity in faster-growing non-regulated names. They both want to be able to see a clear path to growth—that makes it easier to predict future earnings—and some utilities with a bigger footprint in renewable energy, including NextEra Energy, fit the bill.

Read MoreWill Tesla's energy-storage solution lower your electric bill?

NextEra is a premier player in the wind sector, Shaughnessy said, and it's now able to build turbines without government subsidies. It also has a more traditional utility business in Florida, which is one of the most efficient and low-cost operations in the country.

She also likes independent power producers, such as Exelon. It's down about 8 percent year-to-date, but it's a "solid utility business," according to the MFS portfolio manager. It will benefit from a reduction in coal plants—a trend that's putting pressure on energy supply across the country—and a general rebound in the power producer sub-sector, which hasn't done as well as the regulated operations over the last three years.

While there still will be some ups and downs, thanks to its year-to-date declines, the sector offers more opportunities now than a year ago. Shaughnessy cautions investors against getting caught up in the interest-rate uncertainty—they should focus on valuation. And by that measure, a number of these stocks look attractive and still have room to run.

"The markets are crazy, and there have been various macro freak shows," Shaughnessy said. "But you have to buy into those freak shows—that's when the opportunity presents itself. I've been doing this for a number of years. When I want to put my own money in, then that tells you something."

—By Bryan Borzykowski, special to CNBC.com