U.S. stocks closed mixed Thursday as investors digested the Federal Reserve's rate hike decision and Fed Chair Janet Yellen's press conference. (Tweet This)

The Dow Jones industrial average and S&P 500 closed lower, while the Nasdaq Composite eked out mild gains. The major indices gave back an intraday spike of more than 1 percent, amid Yellen's press conference.

Stocks initially fluctuated between slight gains and losses in the minutes after the Fed statement showed the central bank kept interest rates unchanged.

"I think the stock market would like the Fed to have a statement with a vote of confidence in the U.S. economy. I think they were a little surprised. I think the stock market is a little confused right now. I don't think this statement removed much uncertainty," said John Bredemus, vice president, Allianz Investment Management. "I think the uncertainty is around whether the U.S. economy can continue to grow given the weakness in the global economy."

Read More Fed holds off, markets now betting on hike in 2016

It's "yet another Fed meeting and another punt. Investors will have to deal with the uncertainty of when a rate hike is going to occur," said Mike Baele, senior portfolio manager at the Private Client Reserve at U.S. Bank.

The Dow closed down 65 points after rising as much as 193.48 points in late afternoon trade.

The S&P 500 failed hold above the 2,000-level after hitting it in the hour before the statement release, the first touch since Aug. 21. Some analysts had expected the Fed would raise rates if the S&P topped 2,000.

"Really what happens tomorrow will be critical of what the market thinks the Fed said today," said Lance Roberts, head of Streettalklive.com

"The statement—it brings back to the stock market's mind what caused the stock market to drop precipitously in the last few weeks," said David O'Malley, CEO of Penn Mutual Asset Management. The "biggest concern is there is more uncertainty, volatility, that's going to come from the pressure in emerging markets."

Utilities closed up 1.3 percent, after briefly jumping more than 2.5 percent, to lead gains on the S&P 500, while financials was the greatest laggard. Regional banks plunged 2 percent.

Treasury yields extended losses, with the 10-year yield at 2.19 percent.

The fell to 0.68 percent, wiping out its gains for the week. The yield held above 0.80 percent prior to the statement release and began falling in the minutes leading into the release.

"Despite all the hoopla (the Fed's) really being status quo and Janet Yellen has been referencing that in the press conference that's she's holding," said Myles Clouston, senior director at Nasdaq.

"Unless China takes another leg down the market does seem to be handling it a lot better than it had been when there was a lot of panic and fear driving the (U.S.) market," he said.

Read MoreAll eyes on the Federal Reserve: Live coverage

In contrast with the U.S. Fed's trajectory towards tightening, major central banks around the world are in easing mode as global growth remains sluggish.

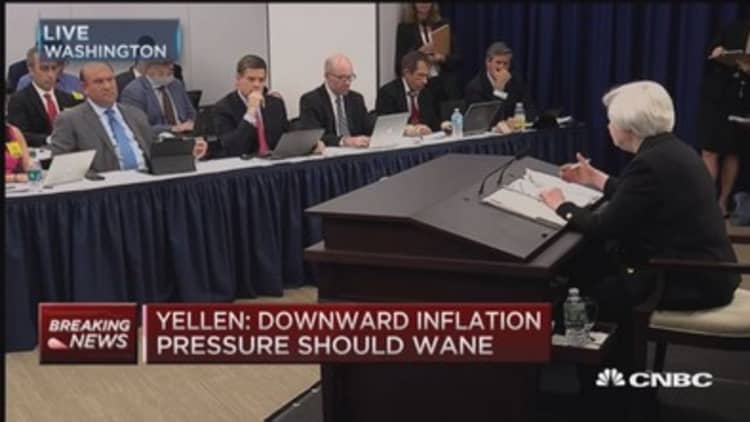

The Federal Open Market Committee concluded a highly anticipated two-day meeting Thursday afternoon. Fed Chair Yellen reiterated at the subsequent press conference that the path of a rate hike is more important than the timing of the first one.

Going into the meeting, Wall Street was split over whether the Fed would move Thursday. Forty-nine percent of financial experts surveyed by CNBC expected the Fed to raise rates this month. A hike would have been the first one since 2006.

Read MoreRising interest rates: What you need to know

Crude settled down 25 cents at $46.90 a barrel after surging 5.7 percent Wednesday.

OPEC forecasts oil prices will grow by no more than $5 per barrel a year to reach $80 by 2020, according to OPEC sources.

Gold futures settled up $2.00 at $1,117.00 an ounce.

The U.S. dollar traded about one percent lower against major world currencies, with the euro topping $1.14 and the yen near 120.00 yen against the greenback.

Earlier, Randy Frederick, managing directors of trading and derivatives at Charles Schwab said the firm still sees opportunities in the tech and financial sectors. "I don't know what the initial reaction is going to be but I don't think it warrants any major changes in what we've been looking at," he said.

Read MoreLessons from Lehman: Spotting the next crisis

In morning trade, the major averages attempted modest gains, essentially holding little changed from the rally of the last two days.

In morning economic news, initial jobless claims declined slightly to 264,000. August housing starts fell about 3 percent.

The Philly Fed Index for September came in at negative 6.0. August's read was positive 8.3.

U.S. stock index futures held mildly lower after a solid two-day rally that many attributed to expectations the Fed would not raise rates.

Stocks closed more than half a percent higher Wednesday, with the Dow adding 140 points after closing about 229 points higher Tuesday and the S&P 500 within 5 points of the psychologically key 2,000 level.

"The SPX cleared intraday resistance yesterday, breaking out from a short-term triangle pattern," BTIG Chief Technical Strategist Katie Stockton said in a morning note. "The breakout would be confirmed on another close above 1,994 today, which would support near-term upside follow-through and a test of more important resistance in the 2,000-2,010 area. Regardless, if today's close is in the upper half of the day's high-low range, we would see that as a positive reaction to the Fed announcement."

Overseas, major European indices closed narrowly mixed as investors awaited the Fed's decision.

The Shanghai Composite index closed down 2.08 percent amid volatility, while Japan's Nikkei finished 1.43 percent higher.

Major U.S. Indexes

On the earnings front, Rite Aid reported before the bell. Adobe Systems was expected to report after the bell.

Rite Aid closed down 10.8 percent after posting quarterly profit of 2 cents per share, compared to estimates of 4 cents a share, though revenue was above forecasts. The drug store chain also trimmed its earnings guidance slightly to reflect recent sales trends and additional amortization expense from its acquisition of pharmacy benefits manager EnvisionRX.

Read MoreEarly movers: CVC, ORCL, RAD, LB, NVDA, EXPE, GM, TGT & more

The Dow Jones Industrial Average closed down 65.21 points, or 0.39 percent, at 16,674.74, with JPMorgan Chase leading decliners and UnitedHealth the greatest advancer.

The Dow transports closed about 0.4 percent higher, with airlines leading advancers.

The closed down 5.11 points, or 0.26 percent, at 1,990.20, with financials leading six sectors lower and utilities leading health care and both consumer sectors higher.

The Nasdaq closed up 4.71 points, or 0.10 percent, at 4,893.95. Apple slid 2.14 percent, while the iShares Nasdaq Biotechnology ETF (IBB) closed up 2.07 percent.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, held near 21 after briefly falling before 20.

About three stocks advanced for every two decliners on the New York Stock Exchange, with an exchange volume of 1.0 billion and a composite volume of nearly 4.2 billion in the close.

On tap this week:

Friday

10 a.m.: Leading indicators

Saturday

1:30 p.m.: San Francisco Fed President John Williams on the economic outlook

3:30 p.m.: St. Louis Fed President James Bullard on the economy and monetary policy

More From CNBC.com: