Denis Horrigan, a partner at financial advisory firm Connecticut Wealth Management, need look no further than his office's backyard for a reminder of how even the wealthy can wind up in a financial mess.

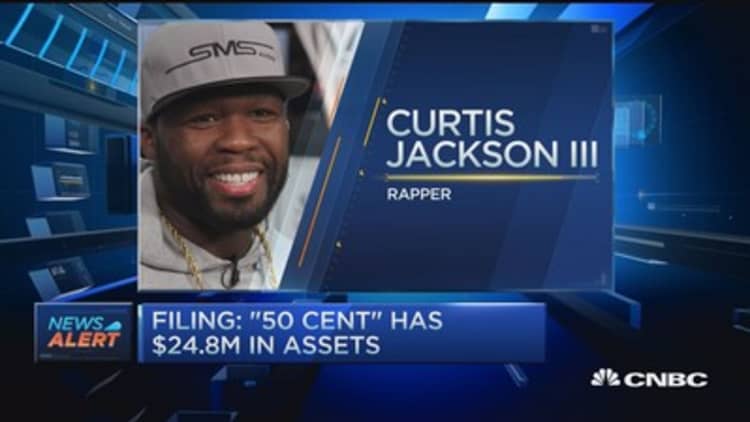

His firm, in Farmington, Connecticut, sits in the shadow of the 56,000-square-foot mansion owned by famed rapper Curtis Jackson (a.k.a., 50 Cent), who filed for Chapter 11 bankruptcy protection in July. Jackson, whose breakout album is titled "Get Rich or Die Tryin,'" reportedly bought the 52-room spread from boxing legend Mike Tyson, who also amassed a fortune only to end up filing for bankruptcy.

According to a statement issued by the law firm representing Jackson, the bankruptcy filing allows the rapper to "continue his involvement with various business interests and continue his work as an entertainer, while he pursues an orderly reorganization of his financial affairs."

Clearly, the bigger they are, the harder they can fall, and that's especially true for people who come into wealth suddenly. Many of us dream of a financial windfall, but often those who are lucky enough to land one ― think lottery winners, professional athletes or entrepreneurs who pocket a big sum from the sale of a business ― end up broke.

Not surprisingly, many people who come into sudden wealth tend to spend with abandon, buying fancy homes, multiple cars and other luxuries without thinking through the long-term financial implications, according to advisors. It is also not uncommon for the suddenly rich to share their wealth with friends and family, doling out big loans or gifts without fully appreciating the possible consequences, both interpersonal and financial.

To that point, according to research from the National Endowment for Financial Education, about 70 percent of people who suddenly receive a large sum of money will lose it within a few years.

Then, there are the entrepreneurs who, feeling highly flush and confident from the sale of a successful business, rush into an ill-fated new venture and wind up losing a big chunk of their net worth.

If you overspend and run out of money and have the taxman running after you, that's not helping your quality of life.Denis Horriganpartner at Connecticut Wealth Management

For many people who come into sudden wealth, "the initial instinct is to spend the money like it is going to last forever," said Horrigan, a certified financial planner whose clients include business owners, doctors and other types of wealthy individuals.

"For us it's extremely important to map out the rest of that client's life as it relates to their money, to make sure they don't begin habits that can cause them to put their financial health at risk," he added.

Many people who are lucky enough to enjoy a financial windfall have what advisor Joe Duran calls a "poverty mind-set," a sense that their wealth is fleeting and that they somehow don't deserve it. That mind-set, he explained, can cause people to make ill-considered financial choices.

"They have the poverty mind-set, and that becomes a self-fulfilling prophesy," said Duran, chief executive officer of advisory firm United Capital. "Strangely enough, a lot of entrepreneurs don't feel worthy of what they have earned.

"That causes them to start giving it away and spending it in incredibly frivolous and unthinking ways," added Duran, author of the book "Start It, Sell It & Make a Mint: 20 Wealth-Creating Secrets for Business Owners."

In researching his book, Duran interviewed 100 entrepreneurs and found that about half of them had seen their net worth shrink dramatically within a year of selling a successful business.

If you've come into sudden wealth, the first thing you ought to do is, well, essentially nothing, according to advisors. Allow yourself a splurge, but only in moderation, and give yourself time to adjust to new realities of your life before pushing ahead with any big financial commitments.

"The biggest mistake that people who come into sudden wealth make is that they don't realize they are in new territory," said Susan Bradley, a CFP and author of the book "Sudden Money: Managing a Financial Windfall."

"They don't create a plan for going forward and take the time to understand their financial limits," she added.

Indeed, handling sudden wealth astutely involves some discipline and soul-searching, according to advisors. Not only is it important to refrain from making big financial decisions at first, but it also behooves those sitting on a windfall to map out a vision for their lives. Doing so will help to ensure that spending decisions align with short-, medium- and long-term goals.

When helping clients navigate a financial windfall, Horrigan of Connecticut Wealth Management runs cash-flow projections that take into account the various options a given client is mulling, whether that's prefunding a grandchild's college education or making a big donation to charity.

The exercise, he said, helps clients understand how various decisions might impact their long-term financial health. He also reminds clients who are sitting on a windfall to get a clear understanding of their tax liability before making any big spending decisions.

"You want to have this money improve your quality of life," he said. "If you overspend and run out of money and have the taxman running after you, that's not helping your quality of life."

―By Anna Robaton, special to CNBC.com