Do you ever wish you could turn back time and save more, earn more or make better investment choices?

If so, you are among the 75 percent of Americans that have financial regrets, according to a new study from Bankrate.

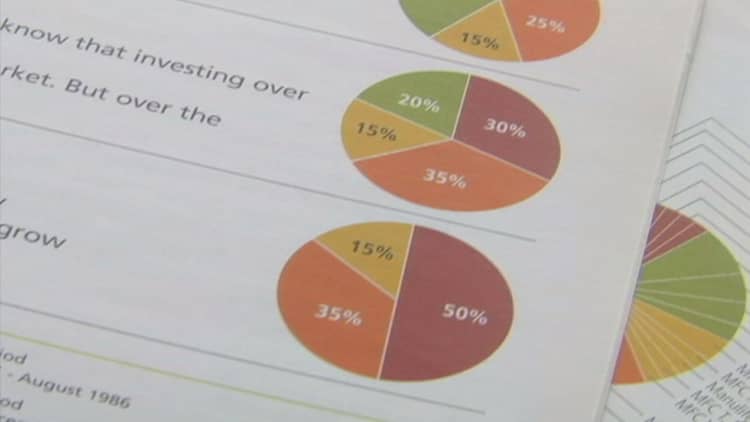

The most common regret was "not saving enough for retirement," chosen by 18 percent of respondents, ahead of "not saving enough for emergencies" (13 percent) and taking on too much credit card debt (9 percent). Only 17 percent of respondents reported having no financial regrets at all. The survey polled more than 1,000 Americans in May, with a margin of error of 3.6 percentage points.

Anxiety over past financial decisions is common, said Erika Safran, a New York City–based financial planner.

A client she once saw had sold his apartment, only to discover he was now priced out of both his desired new neighborhood and his former one. Another client had not saved a nickel for her son to go to college, while another regretted purchasing real estate out of his price range. And yet another had made poor financial decisions that forced him to sell his family vacation home, Safran said, which caused discord with his loved ones.

"When my clients come to me asking me how to get themselves out of difficult situations, I don't beat them with a stick," Safran said. "People are always trying to mend the fences."

The survey results suggest saving seems to be a bigger problem for Americans than debt, said Greg McBride, senior vice president at Bankrate. While taking on too much student loan debt topped worries for respondents aged 18 to 29, about 61 percent of respondents older than 50 reported their greatest worry was not saving enough for retirement.

"The regrets about debt are concentrated among younger people, and then it dissipates by the time you get to retirement," McBride said.

But young people should remember that saving for retirement needs to begin early, he said.

"If you don't start now, it's going to become a bigger and bigger problem," McBride said.

One positive change is that Bankrate's Financial Security Index jumped to its second highest reading since 2010, McBride noted.

"There is a definite trend of improvement," McBride said of growing financial confidence in the years since the Great Recession.

Additionally, more than 30 percent of respondents reported higher net worth in 2016 than one year ago, compared to just 13 percent of people who said their net worth today is lower than it was in 2015.

Some individuals might have a greater net worth this year because of increasing home values, which may not be a sustainable trend, said Safran.

"The secret to improving your financial situation is your cash flow, which doesn't necessarily increase just because your home has appreciated," she said.

Safran suggested that the best measure of financial security would be net worth minus real estate values: "That gives a much better picture of a financial situation for a person," she said.

Plus, a higher net worth this year does not imply a high net worth, McBride cautioned.

"You may have gone from abysmally low to just plain low," he said. "I think people recognize that things still aren't where they need to be."

Millennials were the only age group to say they are more comfortable with their savings than one year ago, according to the study.

"Millennials got the memo," McBride said.

It goes to show that you don't have to have a lot in the bank to be responsible, said Chicago-based financial planner Kevin Meehan.

High income clients sometimes have the biggest money problems, he said, while lower income clients may be in the clear.

"It really has very little to do with income," he said. "People who can control what they save and what they spend regardless of income are going to be the people that are successful financially."