The tough times for crude continue, with the commodity losing another nearly 3 percent in the past week and down about 50 percent year over year. Yet one prominent energy trader thinks we're finally about to see the bottom for oil.

Robert Raymond, founder of hedge fund RR Advisors, correctly called the collapse in five years ago, when the sub-$3 commodity was trading above $5. Now, he's calling crude's next move.

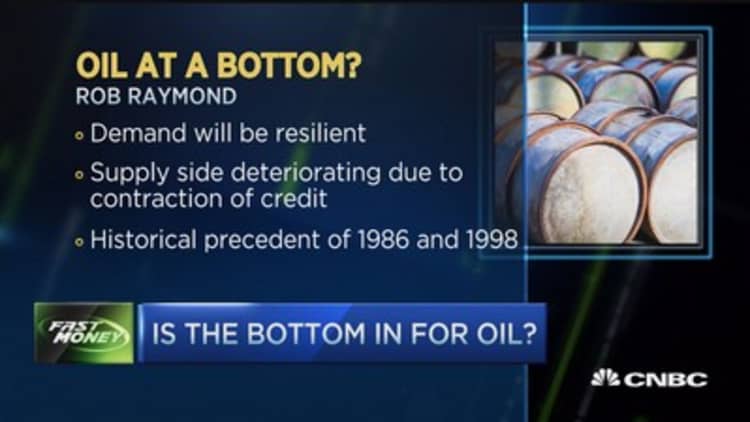

"I think we're going into what we would characterize as the final capitulation phase of the down cycle of the oil market here," Raymond said in a rare interview this week on CNBC's "Fast Money."

Read MoreGoldman: This may push oil to $20

Back up over $60?

Most analysts, such as those at Goldman Sachs, think the end is far from near for oil. On Friday, the investment bank called for crude to sink as low as $20—one of the more aggressive calls among market watchers, many of whom think oil will likely trade somewhere below $40 in the near term.

However, Raymond is looking at a few key developments that are signaling the bottom is near. He expects demand for crude to remain resilient, while supply contracts due to a restriction of available credit. Those factors should help to the price of oil snap back to $65-$75 a barrel, according to Raymond.

Raymond explained that since last year, supply "grew by 5 million barrels a day over [a] 24-month period, while demand grew by 2.3 million, and that resulted in a very oversupplied market," he added. "We're now looking at a reversal of that, if you will, where we're setting up a dynamic where demand is likely to rapidly outgrow or outstrip supply."

He also pointed to a chart looking back at the large oil routs in 1986 and 1998. If historical precedent holds, then crude oil is currently near the end of its trough.

Meanwhile, Goldman is less optimistic. In the Friday note, the bank's commodities research team lowered its 2016 average price forecast for crude to $45 per barrel from $57.