Like a hospital emergency room TV show, audiences have been watching bold Doctor Kuroda (Bank of Japan Governor Haruhiko Kuroda) stabilize his "patient."

In April 2013, he burst through the proverbial ER doors, introducing "quantitative and qualitative monetary easing (QQE)." "Qualitative" means saying he would do whatever it takes. "Quantitative" means blood transfusions. Negative interest rate policy (NIRP) means shinny needle with drugs. What's next?

Next is for Doctor Kuroda to become Doctor House – a diagnostician like Dr. Gregory House (Hugh Laurie) in the television show "House." Why? Emergency-room monitoring devices, like core Consumer Price Index (CPI), do not penetrate enough.

The question is whether these conventional assumptions are true:

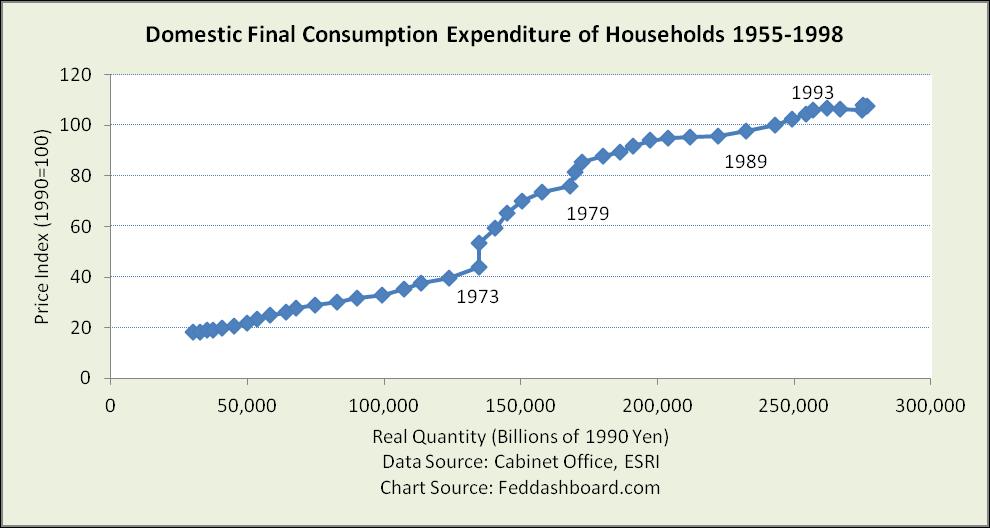

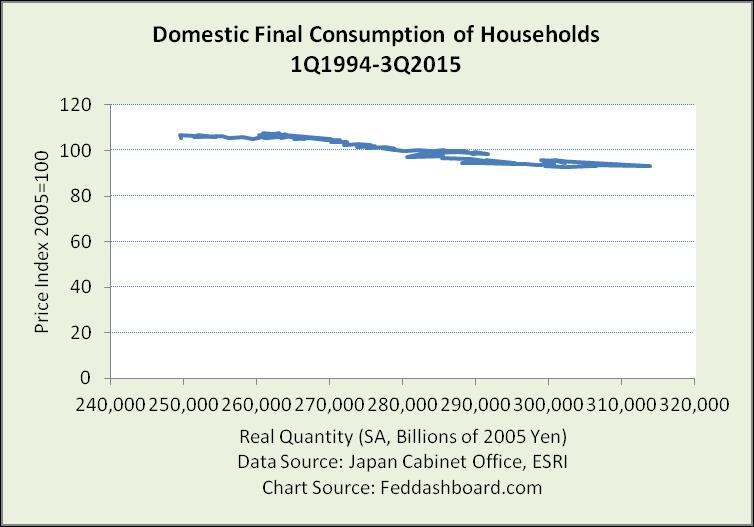

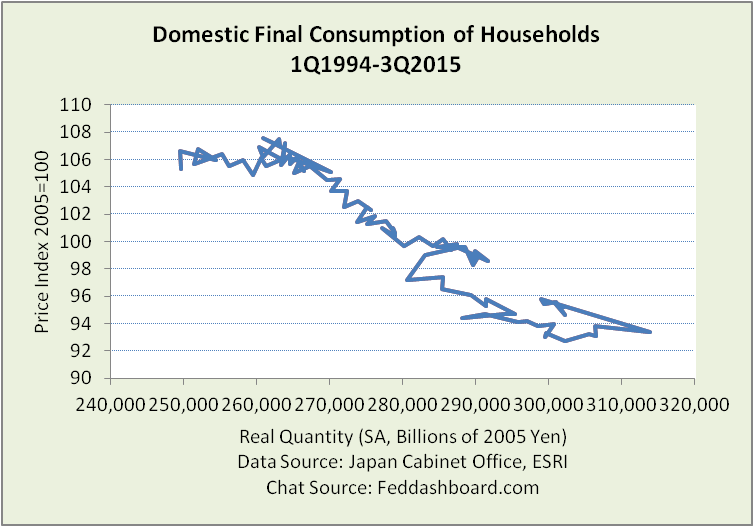

- When the Nikkei index hit a low in June 1992, the consumer price drop was just like any other in history.

- Japanese consumers haven't been buying enough stuff and this is primarily due to a "deflationary mindset."

- "Deflationary mindset" has been due more to monetary policy than tangible product changes.

- Price level changes since the 1990s have been more about money than production cost.

- Prices should have risen over time because of limited workers, land or raw materials.