The U.S. Federal Reserve's "wildly accommodative" super-low interest rates and bond-buying program risk triggering the next world financial crisis, market veteran Stephen Roach has warned.

"Monetary accommodation, to the point of ignoring the stresses and strains of financial stability and what they mean for asset markets and credit markets, is something that needs to be seriously rethought," the Yale lecturer and former chairman of Morgan Stanley Asia told CNBC.

The U.S. central bank's balance sheet stood at $4.33 trillion as of Wednesday, up nearly $0.90 trillion on the year before. It has ballooned since the introduction of bond-purchases to stimulate the economy following the global financial crisis of 2007/08.

Last year, the Fed purchased $85 billion in agency mortgage-backed securities and Treasury notes each month, before moving to gradually cut back. In July, it will purchase a total of $35 billion in assets.

Read MoreMortgage-Backed Securities: CNBC Explains

"Now we have such distance from the depths of the events in the aftermath of Lehman Brothers that we need to be thinking about the next crisis again," said Roach.

"As long as the Fed remains as widely accommodative as a $4.25-4.50 trillion dollar-balance sheet would suggest, there is good reason to question the Fed's commitment to financial stability and there is good reason to believe that we could, in the not too distant future, find ourselves in another mess."

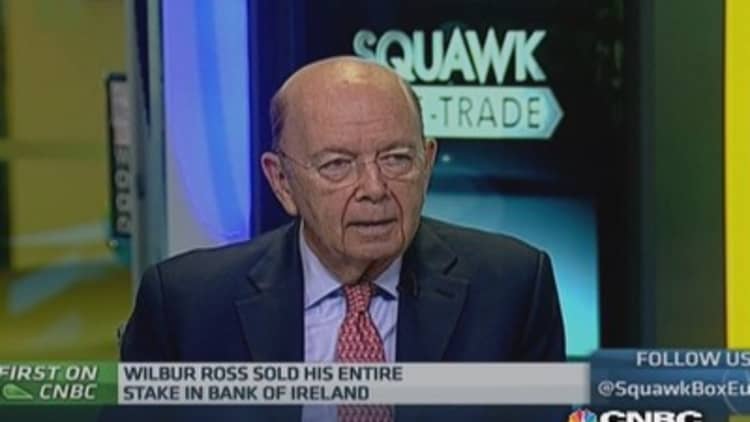

Roach's fears echoed those of U.S. billionaire Wilbur Ross, who warned that ultra-easy monetary by major central banks had created the "ultimate bubble" in sovereign debt.

"I've felt for some time that the ultimate bubble, when we look back a few years from now, is going to be sovereign debt, both U.S. and other, because it's way below any sort of reversion to the mean of interest rates," he told CNBC on Monday.

U.S. sovereign bonds held gains on Thursday, yielding around 2.557 percent, after a surprisingly hefty downward revision to the official first-quarter GDP estimate. The revised figure piqued hopes the Fed will hold off on any prospective rate hikes.

—By CNBC's Katy Barnato