It's been a record year for health-care mergers and acquisitions. But the traditional targets—biotech companies—haven't been the main event, as buyers have increasingly looked for overseas acquisitions in tax inversion strategies.

"While health-care M&A deal size year to date has surpassed any year in the last 10 years, multibillion-dollar biotech M&A has been fairly lackluster," Michael Yee, an analyst with RBC Capital Markets, wrote in a research note Sunday.

Roche's $8.3 billion deal for Brisbane, California-based InterMune, announced Sunday, is one of the few this year that returns to the traditional model of big pharma buying smaller biotech. Merck's purchase of hepatitis C drug developer Idenix Pharmaceuticals, for $3.85 billion—more than three times its value—was another.

Those deals, though, have been eclipsed by others focused on taxes, such as Pfizer's almost $120 billion attempt for AstraZeneca and AbbVie's successful $54 billion bid for Shire.

Read MoreRoche to purchase InterMune in $8.3 billion deal

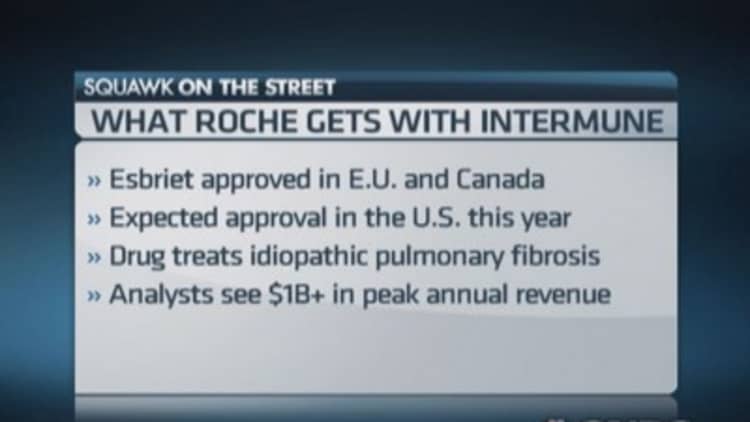

With InterMune, Roche gets the drug Esbriet for idiopathic pulmonary fibrosis, a fatal lung-scarring disease with an unknown cause. About 100,000 people in the U.S. are estimated to have IPF, and it's typically fatal within three to five years of diagnosis, according to the National Institutes of Health.

Esbriet is approved in Europe and Canada and is expected by analysts to be cleared this year in the U.S. But it's been a rocky path here: the drug was rejected in 2010 and the Food and Drug Administration requested a new clinical trial. That study, called Ascend, was reported in February, and showed the drug reduced the risk of disease progression or death by 43 percent compared with placebo.

"It was this third trial, Ascend, that really made all the difference," Severin Schwan, Roche's chief executive, said in a telephone interview Sunday. It "showed this extremely encouraging data."

As a company that has a drug for a fatal disease with no other major treatment options, InterMune represents what big pharma companies typically seek in acquisitions, said Brian Skorney, an analyst with Robert W. Baird.

"They're looking for unmet medical need products, diseases where you have a lot of pricing power," Skorney said by telephone Sunday. "This hits all those metrics."

Read MorePharma CEOs: Tax system flaws help overseas rivals

Skorney estimates Esbriet will draw $1.7 billion to $1.8 billion in peak sales in 2022, and could be priced at about $80,000 a year in the U.S.

The deal is the largest for Basel, Switzerland-based Roche since 2009 when it paid about $47 billion for the shares of biotech giant Genentech that it didn't already own.

"It's a perfect fit for many dimensions," Schwan said. "It really fits well into our portfolio," he said, citing Roche's pulmonology franchise in Pulmozyme for cystic fibrosis, Xolair for asthma and experimental compounds including lebrikizumab, also for asthma. "It's also a very good cultural fit."

Schwan pointed out the European and U.S. headquarters of both companies are within miles of one another.

"InterMune in Brisbane is literally five miles away from our site of Genentech here in San Francisco," he said. "It gets even closer in Basel; we can almost walk there. It's a little symbolic of the cultural fit of the two organizations and will help us a lot."

The $74-a-share price is a 38 percent premium to where InterMune closed Friday, and a 63 percent premium to where InterMune was trading on Aug. 12, before Bloomberg reported the company was drawing takeover interest from several parties.

"It's a nicer premium than I was expecting," Baird's Skorney said. "I imagine this was a competitive bidding process to get the premium that high."

Even so, biotechs have been on a tear. The Nasdaq biotech index is up 38 percent in the last 12 months, compared with a 20 percent gain for the Standard & Poor's 500. InterMune, before the deal with Roche was announced, had gained 272 percent.

"I'm still often scratching my head a bit about the valuations," Schwan said. He noted the company has consistently focused on "bolt-on" purchases, "very targeted acquisitions which complement our various franchises."

Read MoreThis liver disease could rival hepatitis C

Despite the high valuations in biotech, though, InterMune "is really a pretty unique opportunity in terms of the value we can generate," Schwan said.

RBC's Yee said the deal proves "the appetite for 'blockbuster' biotech drugs with synergy by a bigger company still clearly exists."

His next pick for a takeout? Intercept, whose compound for the liver disease nonalcoholic steatohepatitis, or NASH, he says could draw interest of companies such as Bristol-Myers, Merck and Johnson & Johnson.

All four companies declined to comment.

—By CNBC's Meg Tirrell