Paul Singer is deeply pessimistic on the state of the developed world.

The conservative, cantankerous hedge fund manager thinks economic stimulus in Europe isn't likely to work and that the U.S. political system will remain dysfunctional, even with Republican midterm gains.

"With euro interest rates at record lows, we cannot imagine that the ECB's recently announced QE [quantitative easing] program will improve Europe's serious economic situation," Singer said of the European situation in a private letter to investors. "On the other hand, QE might have unpredictable and large negative repercussions if it triggers a generalized loss of confidence."

ECB refers to the European Central Bank, which is engaged in quantitative easing, or the buying billions of dollars of bonds each month to try to spur regional economies.

Read MoreSinger: 'Cushion to withstand risks is very low'

Singer's recommendation is the reform of taxes, labor rules, education, regulation and government assistance programs, to name a few. But he deems such change unlikely, making many countries essentially deadbeats.

"Almost all of the countries in the euro block are long-term insolvent [as are Japan and the U.S.] because of a combination of debt and unpayable long-term entitlements," the billionaire investor wrote.

The U.S. isn't much better off, according to Singer.

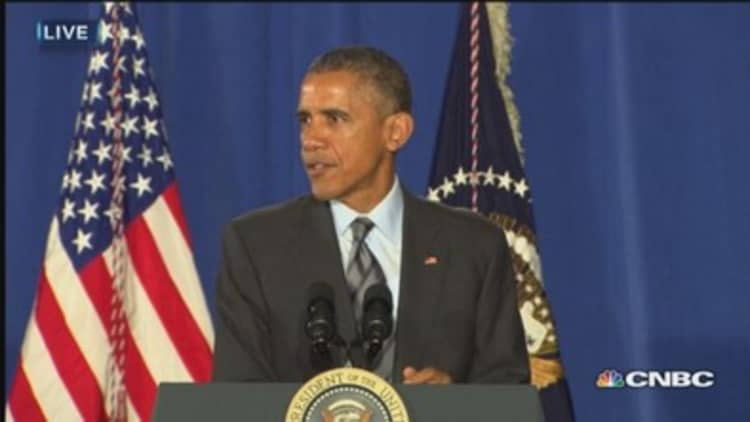

He called the Republican gains in the recent midterm elections a "repudiation" of President Barack Obama and some Democratic policies. But he said change isn't likely because the White House isn't willing to work with conservatives.

"President Obama gives no sign of wanting to work with Congress, and also gives no sign of wanting to pursue a different agenda. Thus, the current tax and regulatory landscape is likely to remain in place at least for the next couple of years," Singer wrote.

That lack of change in Washington makes Singer pessimistic about the economy.

"It is hard to imagine the American economy lighting up under such conditions," the letter said, "even without the gravitational forces exerted by Europe's travails, the strengthening of the dollar, the oil crash, Japan's highly uncertain path, potential economic changes in China or the uncertain event stream of Islamic jihad, Russian expansionism and continued chaos in the Middle East."

Read MoreHot topic for the 1 percent at Davos: Inequality

Elliott managed $25.1 billion as of Jan. 1, making it one of the largest hedge funds in the world. The flagship Elliott International fund gained 6.8 percent net of fees in 2014; its average annual performance since 1994 is 12.5 percent, according to the letter. The S&P 500 index gained 13.7 percent and 9.8 percent over the same periods, respectively.

A spokesman for Elliott declined to comment.