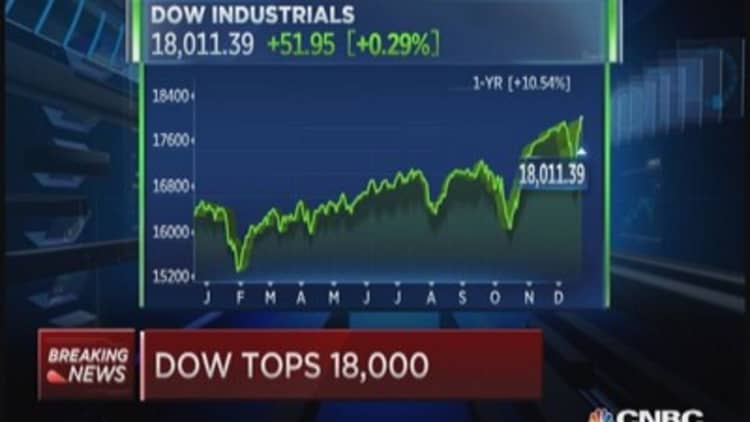

The S&P 500 and the Dow Jones Industrial Average set records in a fifth day of gains as investors cheered data showing the U.S. economy expanded in the third quarter by the most in 11 years.

"Whenever we hit a milepost, the news is spread to the mainstream, and a lot of people are still concerned about the market from 2008, so the round numbers help us move the Wall Street numbers to Main Street," Art Hogan, chief market strategist at Wunderlich Securities, of the Dow closing above 18,000 for the first time.

"The GDP number blew everybody away," said Hogan.

The key theme coming into 2015 is a confident consumer that is driven by the tail winds of higher levels of employment, lower costs of energy and higher equity market. Your 401K is doing better, your job is doing better and it cost less to fill up your tank. 2015 investing will be everything that is facing the consumer," Hogan said.

The Nasdaq, however, fell, snapping a four-session winning streak, as biotechnology names weighed.

"This is just a flushing out of valuations in a sector that is very momentum driven," said Hogan, who noted the unraveling followed the more than 14 percent drop on Monday by Gilead Sciences after Express Scripts Holding said it would no longer cover the drugmaker's hepatitis C treatment in most cases.

Shares of Gilead on Tuesday fell another 3.7 percent.

Major U.S. Indexes

After rising as much as 109 points, the Dow Jones Industrial Average closed 64.73 points, or 0.4 percent, higher, at 18,024.17, with Chevron leading blue-gains that extended to 25 of 30 components.

Also rising to an intraday record posting its 51st record finish of the year, the advanced 3.63 points, or 0.2 percent, to 2,082.17, with energy pacing gains and health care the sole laggard among its 10 main sectors.

Erasing initial gains, the Nasdaq slid 16 points, or 0.3 percent, to 4,765.42.

For every share falling, nearly two rose on the New York Stock Exchange, where nearly 693 million. Composite volume topped 3 billion.

Tuesday's economic reports had the U.S. economy soaring by 5 percent in the third quarter, the most rapid pace since the same period of 2003, while a separate report had orders for durable goods unexpectedly dropping in November.

Read MoreInstant analysis: Trading the monster GDP beat

"We've got strong seasonals, meaning this time of the year is bullish for the market; we've got stabilization in energy, with both Brent and WTI lifting a little bit, as is natural gas, and spectacular economic data; GDP blew out expectations as did personal consumption," said Hogan.

"People are certainly these days looking on the bright side of any data point," said Dan Greenhaus, chief strategist at BTIG.

But Greenhaus finds some of the enthusiasm following Tuesday's economic reports to be a bit misplaced: "The durable goods number is worrisome for the fourth quarter."

Other reports had consumer sentiment at 93.6 in December versus a 93.5 estimate and the sale of new single-family homes falling for a second month in November.

"If there's one thing that didn't improve in 2014, it's the housing market," said Hogan.

Walgreen rose after the drugstore chain reported quarterly earnings that topped estimates; Keurig Green Mountain fell as the coffee recalled 6.6 million of its Mini Plus coffee makers because of a possible burn hazard.

Read MoreMidday movers: Hertz, Ocwen, Coca-Cola & more

The U.S. dollar rose against the currencies of major U.S. trading partners and the yield on the 10-year Treasury note rose 10 basis points to 2.2258 percent.

On the New York Mercantile Exchange, crude futures for February rose $1.86, or 3.4 percent, to $57.12 a barrel; gold futures dropped $1.80, or 0.2 percent, to $1,178.00 an ounce.

On Monday, U.S. stocks rose, with technology leading the Dow and S&P 500 to record finishes.

Coming Up This Week:

Wednesday

8:30 a.m.: initial claims

1130 am $29 billion 7-year note auction

1:00 p.m.: stock market close

Thursday

Christmas Day holiday

Friday

U.S. markets reopen

More From CNBC.com: