A tweet by user PookleBlinky showing how hard it is to afford rent on minimum wage has gone viral, racking up 60,000 retweets and counting and starting a spirited conversation about income and housing in America.

There's only one problem, as some critics have noted: It's not terribly useful to compare federal minimum wage with the average U.S. rent. Local median rents would be a fairer metric.

But research from 2017 that uses local median rents came to a similarly grim conclusion. Though the absolute least that an employer is legally allowed to pay an employee for an hour's work varies across the country, one fact remains constant: In no state does working 40 hours a week for minimum wage enable a person to rent a median two-bedroom apartment.

That's according to findings from the National Low Income Housing Coalition covered by The Washington Post. Across the country, the NLIHC reports, even full-time workers would have to make about or more than twice as much to afford a typical home.

In states such as Alaska, Washington, Colorado, Florida, Virginia, Illinois and most of the Northeast, workers would have to make over $20 an hour. Workers in California, D.C. and Hawaii are the hardest hit by the price of housing: They need to earn a whopping $30, $33 or $35 an hour, respectively, to afford a two-bedroom.

The federal minimum wage is $7.25.

Some renters can still find individual apartments that charge less than the median rent and so remain relatively affordable. The trouble is, they are often substandard or unsafe and, regardless, there aren't nearly enough of those to meet demand. Scarcity has been an issue for decades.

Likewise, not all workers are subject to the federal minimum wage. Some are, as five states, including Mississippi and Louisiana, have no official minimum wage, and two more, Georgia and Wyoming, have a minimum wage of $5.15, or about $10 less an hour than full-time employees would need to make to be able to afford a two-bedroom. In those places, the federal minimum wage applies, with a general exception for workers who receive tips.

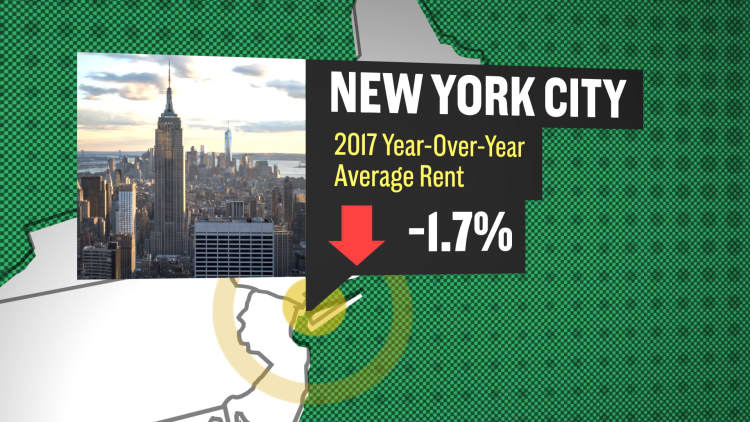

By contrast, states such as Connecticut and California mandate that even entry-level workers receive about $10 an hour, while cities and, increasingly, states such as Illinois and New York are phasing in a new minimum wage of $15 an hour. That minimum supersedes the federal one.

The Fight for $15, a worldwide effort to raise wages and strengthen unions, has successfully led to better pay in many places since its launch in 2012, and a proposed federal minimum wage of $15 an hour was part of the Democratic Party platform in 2016. According to these numbers, however, even that wouldn't make housing affordable.

As things stand, an American making the federal minimum wage of $7.25 would have to work 94.5 hours a week, or more than two full-time jobs, to afford a typical two-bedroom rental.

The Post notes that "many of the occupations projected to add the most jobs by 2024 pay too little to cover rent. These are customer service representatives, personal care aides, nursing assistants, home health aides, retail salespeople, home health and food service workers who make, on average, between $10 and $16 an hour. ... as a result, more than 11.2 million families end up spending more than half their paychecks on housing," money they could otherwise direct toward transportation, education, food, clothing or savings.

In a preface to the report, U.S. Rep. Keith Ellison, D-Minn., writes, "Each year, Congress spends about $200 billion to help house American families. A full three-fourths of these resources go to help subsidize the homes of the richest families through the mortgage interest deduction and other homeownership tax benefits."

Meanwhile, the report points out, federal funding for housing assistance programs has actually declined by 3 percent in the last seven years.

Some business owners argue that raising the minimum wage will lead to higher prices for consumers, and some economists argue that it could depress job growth or even end up eliminating positions as it leads to more automation. A comprehensive 2016 study from the National Employment Law Project, however, found that the economists' fears aren't justified.

Its authors declare that there is "no correlation between federal minimum-wage increases and lower employment levels, even in the industries that are most impacted by higher minimum wages. To the contrary, in the substantial majority of instances (68 percent) overall employment increased after a federal minimum-wage increase."

A 2017 poll found that bipartisan majorities of Americans now favor raising the minimum wage.

As PookleBlinky also points out, citing research from The New York Times, minimum wage earners aren't kids working summer jobs anymore. These days, "the average age of a person on minimum wage is 35. 55% are women. 78% have diplomas. 25% have kids. 50% are sole wage earners."

Don't miss: The 12 best states for first-time home buyers

This is an updated version of a previously published story.