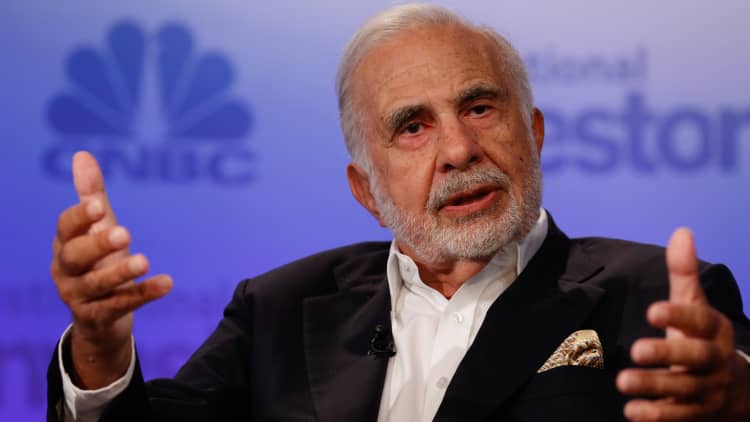

Billionaire Carl Icahn told CNBC on Tuesday there are too many exotic, leveraged products for investors to trade, and one day these securities are going to blow up the market.

The market is a "casino on steroids" with all these exchange-traded funds and exchange-traded notes, he said.

These funds, especially the leveraged ones, are the "fault lines" that will eventually lead to an earthquake on Wall Street, he said. "These are just the beginnings of a rumbling."

The latest example is an obscure security, designed to be a bet on a calm market, that's being blamed for causing an influx of selling in recent days. The VelocityShares Daily Inverse VIX Short-Term exchange-traded note (XIV) blew up overnight as investors were forced to sell when the market went haywire.

As a result, Credit Suisse on Tuesday said as of Feb. 20, it will end trading for its XIV, which was supposed to give the opposite return of the Cboe Volatility Index (VIX), often referred to as the market's fear gauge.

"The market itself is way over-leveraged," Icahn said on "Fast Money Halftime Report," predicting that "one day this thing is just going to implode." He described the possible implosion as "maybe eventually worse than 1929," making reference to the stock market crash that contributed to the Great Depression.

"The market has become a much more dangerous place," he said, adding the current volatility is a precursor of potential trouble. "It's telling you something, giving you a warning."

Investors are piling into index funds thinking they'll never go down, Icahn said. "Passive investing is the bubble right now, and that's a great danger."

But as much as he was sounding alarm bells, Icahn said, "I don't think this is the explosive time." The market will "probably bounce back," he continued. "I don't think this is the beginning of the end."

The stock market entered its third day of huge sell-offs and volatility on Tuesday. A day after plummeting 1,600 points, the Dow Jones industrial average opened lower, plunging as much as 567 points and dipping into correction territory before quickly swinging 367 points higher. The index has since been trading back and forth between positive and negative territory.

Icahn, an activist investor who often pushes for changing struggling companies, was an early supporter of Donald Trump for president and a confidant during the 2016 campaign. The chairman of Icahn Enterprises later became an advisor on regulation to Trump but resigned in August, facing criticism over his role in an energy firm seen as a conflict of interest.

Shortly after the November 2016 election, Icahn said, he left Trump's victory party early to take advantage of the market dip and bet about $1 billion on stocks.

Icahn, who has been investing in the market for four decades, reflected on CNBC Tuesday about his election night buying, saying it was obvious then that Trump would get rid of regulations that hamper business and the market would eventually respond positively.

Even with three sessions of intense selling, the Dow and were up about 32 percent and 24 percent, respectively since Trump won the presidency.