While CNBC's Jim Cramer is content to blame the market's recent sell-off on high-risk products that traders used to bet against volatility, he knows there could be more to the story.

That's why the "Mad Money" host recruited technician Carley Garner, the co-founder of DeCarley Trading and the author of Higher Probability Commodity Trading, to get to the bottom of the drastic correction.

"In Garner's view, there's a whole lot of blame to go around. It's not just the fault of foolish speculators who made big, leveraged bets that the market would stay calm, then were forced to sell common stocks and stock futures to meet their brokers' margin calls," Cramer said on Tuesday.

"Garner thinks the market was already broken in early January. She believes the bulls were victims of their own complacency."

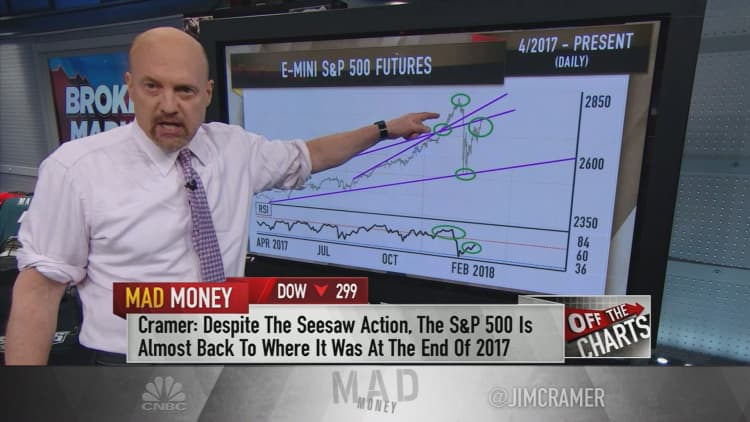

Cramer first called attention to the daily chart of the CME Group's E-mini S&P 500 futures, which trade 23 hours a day, to get a more detailed view of what happened.

Garner noticed that the indicator climbed from the 2,400s in September to the 2,800s in January practically in a straight line, without much consolidation. That trajectory alone told her that the was just as broken at January's peak as it was at February's bottom.

"Her reasoning is pretty simple," Cramer said. "Asset prices aren't supposed to move straight up or straight down unless you have a sudden and dramatic change in the fundamentals — and yes, the big tax cuts certainly count as a big change, but even with tax reform, this was an extreme move."

But the market is rarely rational, especially during bull markets. Garner said investors' emotions also played a big role in the decline: exuberance pushed stocks higher into January, then gave way to panic as the market started to break down.

Garner even made the case that the S&P 500 never should have traded above the 2,730 mark that it reached in early January.

"In fact, the moment we broke through that level, it pretty much broke [almost] all the rules of technical analysis," Cramer noted.

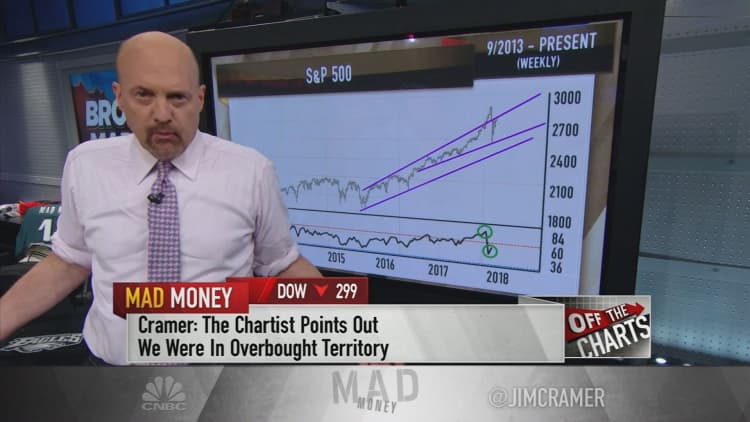

As the S&P 500 approached and crossed that mark, the Relative Strength Index, a key indicator that signals when stocks are overbought or oversold, was screaming that the index had gotten extremely overbought.

To Garner, "these readings were classic signs of a broken market on the upside, yet people who were making money in stocks didn't want to admit that anything was wrong, at least not until the pendulum started swinging the other way," Cramer said.

That's why Garner argued that the market's decline was technically justified — the S&P 500 fell to its floor of support, the long-term trend line, and bottomed before resuming its march higher.

The only reason it seemed so dramatic, Garner said, was because stocks had run up so much before the plunge.

Now, the S&P 500 and its Relative Strength Index have returned to normalcy. To Garner's satisfaction, the bears were ostensibly shaken out — albeit messily — and the bulls' euphoria was tempered.

The technician also accepted Cramer's argument about risky volatility betting being a part of the decline.

"Betting against volatility is really just an extreme type of irrational exuberance because the VIX goes up when the market goes down," Cramer said, relaying Garner's point.

But for Garner, "these VIX traders are the symptom, not the disease," he said. "The actual ailment is euphoria, which is why so many funds were foolish enough to make such a risky bet in the first place."

WATCH: Cramer's charts show the dangers of euphoria

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com