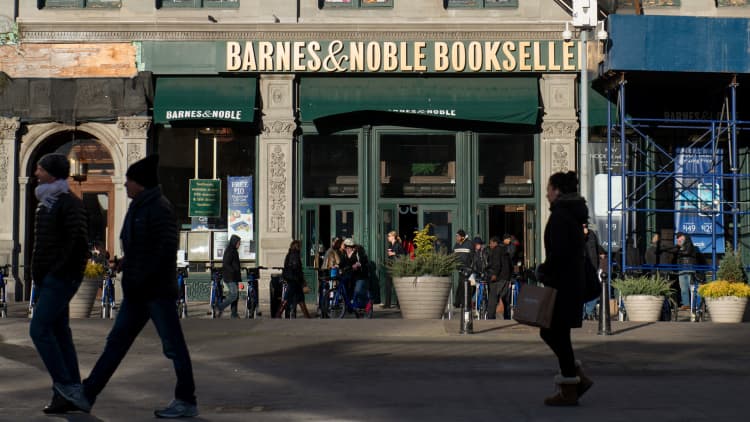

Barnes & Noble is trimming its staff, laying off lead cashiers, digital leads and other experienced workers in a company-wide clearing, CNBC has learned from sources familiar with the matter.

The news came abruptly for many workers who showed up Monday morning at various Barnes & Noble locations to be notified that they no longer had a job, the people said. The number of affected workers couldn't immediately be determined. As of April 29 of last year, Barnes & Noble employed about 26,000 people.

"[Barnes & Noble] has been reviewing all aspects of the business, including our labor model," a spokeswoman told CNBC about the layoffs. "Given our sales decline this holiday, we're adjusting staffing so that it meets the needs of our existing business and our customers. As the business improves, we'll adjust accordingly."

Although consumer spending was generally strong this holiday season, not all retailers reaped the rewards. At Barnes & Noble, 2017 holiday sales fell more than 6 percent to $953 million, compared with the year prior. Same-store sales fell 6.4 percent for the holiday period, while online sales dropped 4.5 percent.

The New York-headquartered retailer has increasingly faced pressure from the likes of Walmart and e-commerce behemoth Amazon, which have managed to steal a larger share of the books market. Walmart is planning to make a massive push in selling e-books and e-readers on Walmart.com later this year. Meanwhile, Amazon is opening up more of its own bricks-and-mortar bookstores.

Barnes & Noble is still under pressure to make a move before it's too late to save the company. Last July, activist investor Sandell Asset Management urged Barnes & Noble to sell itself, saying the retailer could fetch at least $12 per share and attract media or internet companies seeking a retail presence. Sandell called the company's real estate "beachfront property" at the time.

Then, having not reached an agreement with Barnes & Noble by November, Sandell proposed to take Barnes & Noble private in a deal that valued the company at more than $650 million, or over $9 per share. The books retailer barked back and called any such deal "highly unlikely."

Earlier Monday morning, Timothy Mantel was named Barnes & Noble's chief merchandising officer, effective immediately, having previously held roles at GNC and Target. Mary Amicucci left the chief merchandising role at Barnes & Noble last September.

Barnes & Noble shares closed down more than 3 percent Monday at $4.70 apiece. The stock has fallen more than 55 percent from a year ago.

WATCH: B&N says investor's proposal not 'bona fide' last fall