"Speak softly and carry a big stick."

According to Peter Schiff, this timeless creed of U.S. president Teddy Roosevelt is the exact antithesis of how Janet Yellen is behaving when it comes to interest rates.

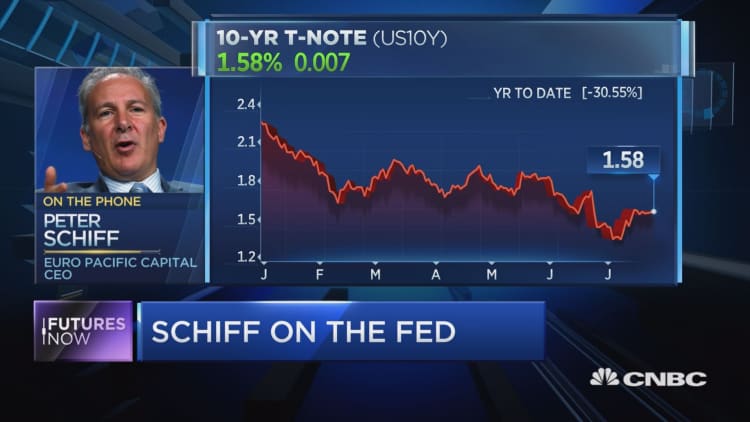

"When it comes to rate hikes, the Fed has no stick. All they can do is speak loudly," explained the CEO of Euro Pacific Capital on Tuesday on CNBC's "Futures Now" when discussing the Fed's strategy in 2016. "The Fed has been bluffing. They're finished tightening."

Furthermore, Schiff believes that the Fed already has the wheels in motion to enact another round of quantitative easing, but wants to represent the possibility of another rate hike to the market. Schiff maintained that if the Fed chooses to raise rates, the whole U.S. economy could implode.

"Instead, they keep positioning that they're about to raise rates, but then they keep coming up with one excuse after another," claimed Schiff, who stuck to the bearish view that the U.S. economy is on the doorstep of another recession.

"I think what they're going to do to ease monetary policy going forward is to adjust their rhetoric," explained Schiff, who noted that the Fed lacks mobility, with only a quarter of a point to maneuver within if it chooses to lower rates. "They'll start talking about not raising rates soon, then they may admit that they no longer have a bias to tightening, then they can say they have a bias to easing."

Schiff was also quick to dismiss Fed policy as the key driver behind this year's rally. Rather, he believes the market's ability to absorb Brexit aftershocks is what has helped stocks climb to record levels in 2016.

"When Brexit happened, central banks starting talking about more stimulus," noted Schiff. "I think it was Brexit that took the Fed out of the game. That's what caused the rally."

Since Britain's vote to the leave the EU, the and S&P rallied 6 and 7 percent from the lows, respectively. With speculation that rates would be lowered around the world, Schiff believes the rally is "phony" and is based on the belief that there will be cheap money readily available for investors.

Schiff added that flawed central bank policies around the world have led to a "bond bubble" and warned investors about the draw of high-yielding treasuries.

"I don't own any bonds," he explained when pressed by "Futures Now" trader Scott Nations on why his bond fund is underperforming the market. "It's a bond fund that has no bonds, because I don't want to participate in a bond bubble. When the bond bubble bursts, my bond fund is going to be number one. All I have is very short-term debt in foreign currencies."

When confronted further by Nations about his call of no interest rates in 2015, Schiff was adamant that a quarter of a point is nothing to write home about.

"If you go back to late 2014, the consensus among most of the people that came on your show was that by the end of this year, the Fed will have raised interest rates between 6 and 8 times," argued Schiff. "I said they wouldn't raise them at all. Everybody was off by a mile! Nobody got closer than me!"

Of course, the Fed raised once in 2015, which led Schiff to maintain that he was far closer to being correct versus his colleagues on Wall Street.

"I knew that the Fed couldn't raise rates! The fact that they did one trivial quarter-point rate hike, and then back-tracked and took [other hikes] off the table proves that I was right," said Schiff. "They raised interest rates, the markets got crushed and the only reason the markets rallied back was because they stopped raising rates!"

The Fed will announce its July rate decision today with additional announcements scheduled for September, November and December. Schiff concluded that the Fed's next move will be a cut, not an increase in rates.