When you're young, retirement can seem too far off to think about. And if you're putting off saving for it, you're not alone: Just 31 percent of millennials are contributing to a retirement account, a new survey from Earnest, Amino and Ipsos finds.

Some experts say that if millennials don't change their habits they'll miss the boat completely. The longer you wait to start saving, the farther behind you'll fall and the more you'll miss out on compound interest, which is what can cause your wealth to snowball over time.

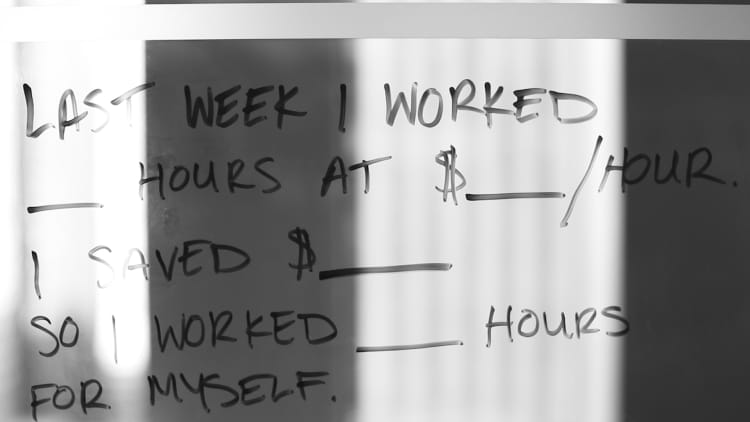

"Many of us tend to say, 'I'll get to retirement savings later,' or 'I have all the time in the world,'" certified financial planner Carrie Schwab-Pomerantz tells CNBC Make It. "Consider the 'minus 10 percent rule': If you're in your 20s and you put aside at least 10 percent, you should have a relatively comfortable retirement at age 65.

"But if you wait until your 30s, you have to save 15 percent to 20 percent of your income. And in your 40s, you have to save 30 percent."

Other experts recommend setting aside at least 10 percent of your income as soon as possible. One report suggests that young people should sock away 20 percent of their income if they want the same level of retirement income adequacy as today's retirees.

To work your way up to that 10-to-20 percent range, start by investing in your employer's 401(k) plan, a tax-advantaged retirement savings account, or other retirement savings accounts, such as a Roth IRA or traditional IRA.

No matter how you choose to save, the most important step is to open at least one account.

Next, follow these three steps so your money can grow over time:

- Contribute as much of your income as you can. If you're funding a 401(k), the contribution limit for 2017 is $18,000 for workers under age 50. If you're funding a Roth IRA or traditional IRA, the maximum yearly contribution is $5,500 for workers under age 50.

- Automate your contributions. Have your employer do a payroll deduction or have your money taken out of your checking account and sent straight to your retirement account. After all, you can't spend money you never see.

- Get in the habit of upping your savings consistently, either every six months, at the end of each year or whenever you get a raise. Again, if you make this automatic by setting up "auto-increase," you won't forget to up your contributions, or talk yourself out of setting aside a larger chunk.

Like this story? Like CNBC Make It on Facebook!

Don't miss: Americans are using this 'loophole' to save more for retirement