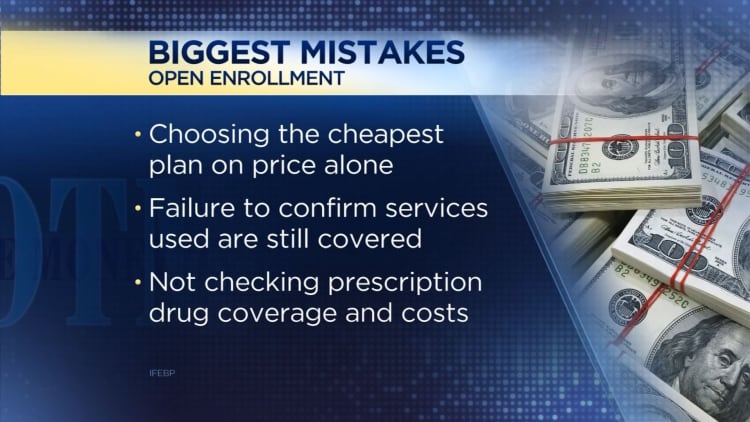

It's open enrollment season, which for many workers, might not mean much. That's a costly misconception.

About half of employees don't understand their benefits materials, according to a report by the International Foundation of Employee Benefit Plans.

As a result, most workers just stick with what they've previously picked — 92 percent of workers last year kept the same selections, according to a separate Aflac survey of 5,000 employees.

That's a missed opportunity. Aflac found that more than half of employees estimate they are wasting up to $750 a year because of suboptimal benefit choices.

At the very least, workers should "take a look and see what their choices are this year compared to last year, to see if their plan still suits their situation," said Julie Stich, vice president at the International Foundation of Employee Benefit Plans.

Here are a few of the things to look out for:

1. Health Insurance

Employers increasingly are shifting more health-care costs to employees, so keeping the same plan could have a different result. The annual premium employees are on the hook for has risen 75 percent over the past 10 years, according to the Kaiser Family Foundation. More workers also must now cover a deductible.

For starters, check out other plans offered by your employer, including a high-deductible health plan with a health savings account, which offers triple tax advantages.

2. Life insurance

Even if you already have a policy through work, it could be a fraction of what you need to protect young children or other dependents.

Consider what's the right amount for you, then weigh whether you want to buy additional coverage through your workplace group plan or shop for your own individual term life insurance policy, a move many advisors recommend.

3. Retirement savings

Open enrollment is also a good reminder to increase your contribution rate for 2018 (the proposed GOP tax plan leaves current contribution limits in place).

In addition, consider the alternatives, like a Roth 401(k) — more employers have been adding this option to their retirement plan and it can boost the potential payoff of getting tax-free income in retirement.

4. Flex spending

If your company offers a health care or dependent care flexible spending account, also known as an FSA, you can put aside pretax dollars from each paycheck up to $2,650 for health-care expenses and up to $5,000 for child and dependent care expenses for 2018. Because the money that goes into your FSA is deducted from your income on a pretax basis, it lowers the amount of income on which you are taxed. (Be aware that the GOP tax plan under consideration would eliminate the dependent care accounts.)

Generally, you'll have to decide during open enrollment how much to set aside for the year, so it's a good time to think about what those costs might be in the months ahead, particularly if you have big-ticket items like braces or summer day camp on the horizon.

— CNBC's Carla Fried contributed to this report.

"On the Money" airs on CNBC Saturdays at 5:30 a.m. ET, or check listings for air times in local markets.

More from Your Money, Your Future:

Pick the wrong Medicare drug plan and the cost could shock you

90% of workers could botch their employer benefits picks

Here's how to snag the best Medicare Advantage Plan