The heavy favorite to be named the next head of the U.S. central bank has indicated he isn't against bitcoin, but isn't embracing the idea of a central bank-issued digital currency.

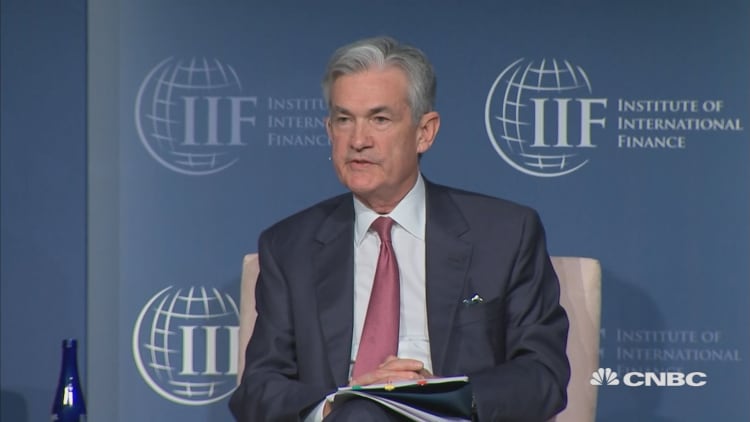

President Donald Trump is expected to announced his pick for the next Federal Reserve chair on Thursday, and the latest reports indicate he has chosen Fed Governor Jerome "Jay" Powell. The current chair, Janet Yellen, is scheduled to end her term in February.

I have "nothing against bitcoin, nothing against, you know, private currencies," Powell said in June at the Economic Club of New York. They are "associated with money laundering and those sorts of issues, but we're not broadly opposed or supportive of alternative currencies."

"I think from a Fed standpoint, I would say I am very cautious of the idea of a Fed digital currency," Powell said.

Bitcoin jumped more than 6 percent to a record above $7,000 on Thursday.

Questions around regulation of bitcoin and a potential for a central bank-issued digital currency have risen this year as bitcoin's price has surged.

While JPMorgan Chase CEO Jamie Dimon has called bitcoin a "fraud," he said in October that he would be more comfortable with a government-backed digital currency. The Bank for International Settlements also said in a September report that central banks may one day need to issue their own cryptocurrencies, since they provide anonymity for consumers and efficiency for institutions.

Many major financial institutions are already experimenting with bitcoin's blockchain technology. Blockchain is a type of distributed ledger technology that allows for a quick, permanent and open record of transactions, theoretically eliminating the need for a third-party intermediary like a bank. Enthusiasts expect that the decentralized and efficient nature of the technology will transform the world as much as the internet did. However, institutions can also create internal blockchains that they control.

Powell is clearly watching. In March, he spoke on "Innovation, Technology, and the Payments System" at a Yale Law School event on blockchain and the future of finance. The Fed governor listed several challenges for widespread adoption of distributed ledger technologies, especially for central banks to issue digital currencies.

The key difficulties are "meaningful technical challenges" and "privacy issues," Powell said. In addition, he said a central bank-issued digital currency "may stifle innovation over the long run" since it would compete with improvements in federal payments technology and private sector innovations.

That said, some researchers have proposed central bank tokens such as Fedcoin, and the central banks of Singapore and some other countries have announced experiments with digital currencies. But the Bank for International Settlements report pointed out that the Fed has not endorsed Fedcoin and no central bank has officially launched a retail or wholesale-use digital currency.

"Powell has warned that any shift towards digital currency would raise serious issues regarding security against cyberattacks and combating illegal activity," said Benn Steil, senior fellow and director of international economics at the Council on Foreign Relations. "Policy on digital currency broadly, however, will remain largely with the Treasury."

The Treasury did not immediately respond to a CNBC request for comment.

Steil also wrote "The Battle of Bretton Woods," a history of a key 1944 international agreement that established the gold-backed U.S. dollar as the global reserve currency. President Richard Nixon ended the dollar's convertibility to gold in 1971, but the greenback has retained its international prominence.

Digital currency enthusiasts often call bitcoin "digital gold" since they believe it will become a widely accepted store of value and is already the primary means of participating in the growing world of cryptocurrencies.

The supply of bitcoin is limited to 21 million, meaning increased demand will only lead to higher prices. Bitcoin hit a record high of $6,629 Wednesday, up more than six times in price for the year, according to CoinDesk. As for gold, its price has barely changed over the last 12 months and traded Wednesday around $1,277 an ounce.

"If central banks issue digital currency, it will most likely be a watered-down version of we have been accustomed to experience with bitcoin and ethereum, for example," said William Mougayar, who organizes a digital coin conference called "Token Summit."

Central banks "will take what they like (mostly efficiency in exchange and tracking) and reject other parts they don't like, like decentralized governance and openness," he told CNBC in an email.

— CNBC's Steve Liesman and Hailey Lee contributed to this report.

WATCH: Trump's reported Fed choice on a variety of topics, including bitcoin