U.S. stocks fell on Thursday after a key vote in the House regarding a Republican-led health care bill was delayed.

The Dow Jones industrial average fell about 5 points, with UnitedHealth contributing the most losses. The 30-stock index had traded about 96 points higher earlier in the session. The S&P 500 slipped 0.1 percent, having traded 0.45 percent higher earlier, as health care and energy led decliners.

The Nasdaq composite fell around 0.1 percent after rising 0.36 percent at session highs.

"This is almost like a Fed meeting; nobody wants to do anything," said Tom Martin, senior portfolio manager at Globalt.

Dow intraday chart

Source: FactSet

The House vote is crucial for the Trump agenda. Trump has said the repeal and replacement of Obamacare must happen before action can be taken on his other plans, including a major tax reduction. Expectations for such policies had been a boon for the stock market's postelection rally.

Republicans need 215 votes for passage. However, the American Health Care Act's passage in the House has been anything but certain.

"The health care bill is really the first 'put up or shut up' moment of Trump's presidency," said Brad McMillan, chief investment officer at Commonwealth Financial Network. "With the health care bill, we now will find out whether meaningful change can really happen — or not."

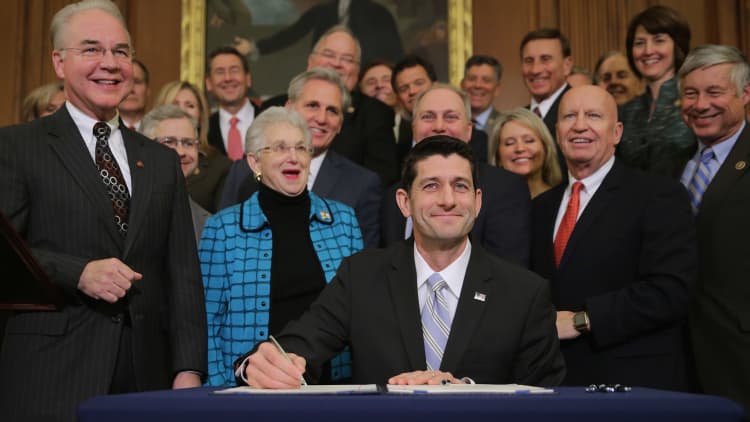

A top GOP source told NBC News the House will not vote on the bill on Thursday. Also, House Speaker Paul Ryan's weekly news conference was postponed until further notice.

The bill, if signed into law, would effectively repeal and replace Obamacare, thus accomplishing one of President Donald Trump's first legislative goals.

"It's kind of funny. Traders are hyper-focused on the health-care vote, but it is still unlikely to go through the Senate as it's currently written," said Matt Weller, senior market analyst at Faraday Research. "It's really more of a symbolic vote."

Equities suffered their worst day of the year earlier this week, in part, because of the concerns surrounding the health-care vote.

"We think this is a normal pullback and consolidation phase after everything that's happened over the past six months, said Lisa Kopp, head of traditional investments at U.S. Bank Wealth Management. "The economic data seems to be positive; that's why we are still positive on stocks for the year."

In economic news, weekly jobless claims rose by 15,000 to 258,000, above the expected print of 240,000. Federal Reserve Chair Janet Yellen spoke at a conference in Washington, D.C., but did not comment on monetary policy.

New home sales hit a seven-month high last month, rising 6.1 percent to a seasonally-adjusted annual rate of 592,000, topping expectations.

U.S. Treasurys traded mixed, as the benchmark 10-year note yield held near 2.41 percent and the two-year note yield hovered around 1.24 percent.

The dollar gained 0.04 percent against a basket of currencies, with the euro near $1.078 and the yen around 111.

"Clearly, the vote is material towards helping sentiment on Trump's reforms, so investors are waiting on the sidelines" ahead of the House vote, said Peter Ng, senior FX trader at Silicon Valley Bank. "The whole reflation trade is based on expectations."

On the corporate front, shares of Ford Motor fell after the company's first-quarter guidance came in lower than Wall Street estimates. General Motors' stock followed Ford lower.

Disney, meanwhile, announced it extended CEC Bob Iger's contract until July 2019.

Major U.S. Indexes

The Dow Jones industrial average fell 4.72 points, or 0.02 percent, to close at 20,656.58, with UnitedHealth leading decliners and Nike the top advancer.

The slipped 2.49 points, or 0.11 percent, to end at 2,345.96, with health care leading seven sectors lower and real estate outperforming.

The Nasdaq composite slipped 3.95 points, or 0.07 percent, to close at 5,817.69.

About nine stocks advanced for every five decliners at the New York Stock Exchange, with an exchange volume of 805.19 million and a composite volume of 3.211 billion at the close.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, traded near 13.1.

On tap this week:

Thursday

7:00 p.m. Dallas Fed President Rob Kaplan

Friday

Earnings: Finish Line

8:30 a.m. Durable goods

8:45 a.m. Chicago Fed's Evans

9:05 a.m. St. Louis Fed President James Bullard

9:45 a.m. Manufacturing PMI

10:00 a.m. New York Fed President William Dudley