Oil prices traded little changed on Thursday, as support from a weaker dollar was offset by a stubbornly high level of U.S. inventories near record highs that suggested OPEC-led output cuts were starting to drain supplies.

The Organization of the Petroleum Exporting Countries and some non-OPEC producers cut production from Jan. 1 to reduce record stocks of crude. But an oil price rally after the deal has been hobbled by data showing persistently rising U.S. stockpiles.

Prices were pressured by data from market intelligence firm Genscape showing a build of more than 2 million barrels in the week to March 14 at the Cushing, Oklahoma delivery point for U.S. crude futures, traders said.

Figures this week showing a modest slide in stockpiles in the United States, the world's biggest oil consumer, helped lift oil prices in the previous session after they tumbled to three-month lows.

The U.S. Energy Information Administration said on Wednesday that crude inventories fell last week, the first decline after nine weeks of increases, but only a dip of 237,000 barrels from a record high.

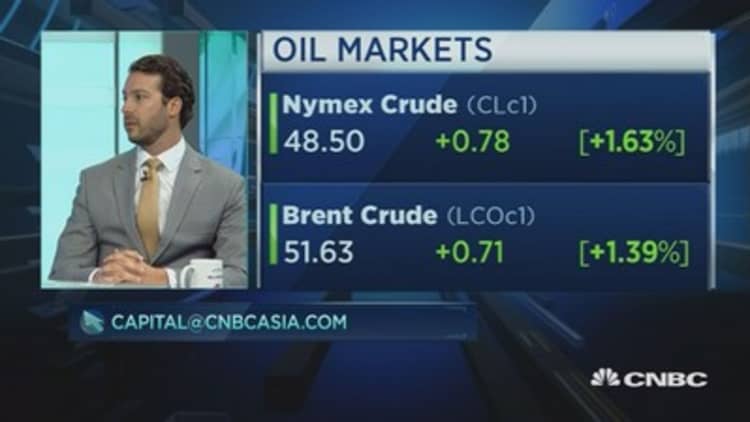

U.S. West Texas Intermediate (WTI) ended Thursday's trade 11 cents lower at $48.75 a barrel, edging off a three-month low hit on Tuesday.

Brent crude oil was down 11 cents to $51.70 a barrel by 2:35 p.m. ET (1835 GMT) , recovering from Tuesday's drop to $50.25, its lowest since Nov. 30 when OPEC announced its supply accord. The price is still nearly $7 below January's post-deal peak of $58.37.

"Market focus remains centered on escalating U.S. production growth and elevated domestic inventory levels, but this is not representative of the rest of the world. Inventories are drawing in several other key regions," RBC Capital Markets analysts said in a note.

"Despite the broad-based headlines of a holistic global oil surplus, we contend that certain markets such as Asia remain in a deficit, while regions like the Atlantic Basin and the U.S. remain in surplus."

Some support came from the U.S. Federal Reserve on Wednesday after it signaled it would not accelerate plans to raise interest rates, depressing the dollar against a basket of currencies and lifting the greenback-denominated oil price.

"I don't think that's going to be a massive influence at this point in time and the main reason being that it is a small move and the risk trade is still on at this point," said Mark Watkins, regional investment strategist at the Private Client Group at U.S. Bank in Park City, Utah.

"Unless there is a global disruption where money needs to move to a safe haven, the interest rate movement isn't going to have a long term material impact at this point in time."

Further support came on Wednesday from the International Energy Agency (IEA). Although global inventories rose in January, the agency said the oil market could be in deficit by 500,000 barrels per day in the first half of 2017.

Analysts said Brent had found a technical support level at the 200-day moving average. But PVM Oil Associates told investors to "treat this recovery with scepticism."

OPEC has broadly complied with its commitment to cut 1.2 million barrels per day in the first half of the year, but investors have been unnerved as stocks have continued climbing. The IEA told investors to be patient as cuts would take time to feed through.

OPEC has said it wants to see inventories fall below the five-year average for industrialized nations. Stephen Brennock of PVM oil brokerage said this would be achieved only if OPEC kept supply reductions beyond the first half of 2017.

"Unless OPEC agrees to extend its self-imposed production restraint beyond the June deadline, any claims of victory in the battle against the oil glut will be premature," Brennock said.

OPEC member Kuwait said this week that it was ready to prolong the deal to reduce supply. But OPEC heavyweight Saudi Arabia, the world's biggest oil exporter, has said it is too early to consider an extension.