Meal kits are practically everywhere, but data suggest consumers might be getting their fill.

Proponents say they're convenient, healthy and more cost-effective than taking the family out for dinner. Yet some new figures obtained by CNBC show their explosive growth is tempering, with early adopters soon giving up the convenience of customized meal prep at home.

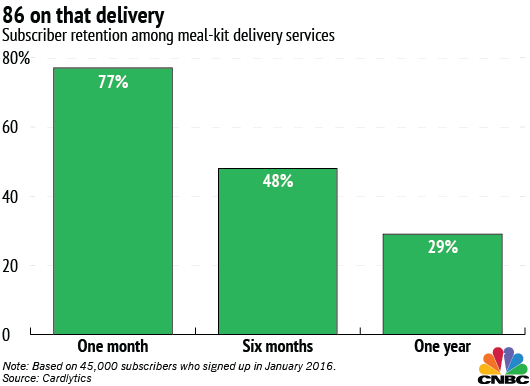

More than half of meal kit subscribers cancel their subscriptions within the first six months, according to data from Cardlytics, a purchase analytics firm, suggesting consumers treat their food services much like a New Year's resolution to join a gym.

In fact, nearly three-quarters of new subscribers gave up the services within a year. For that portion of the study, Cardlytics looked at around 45,000 consumers who first signed up for meal kit services in January 2016.