Oil prices fell nearly 3 percent on Friday after data showed U.S. production and rig counts rose last week just as OPEC exports hit a 2017 high, casting doubt over efforts by producers to curb global oversupply.

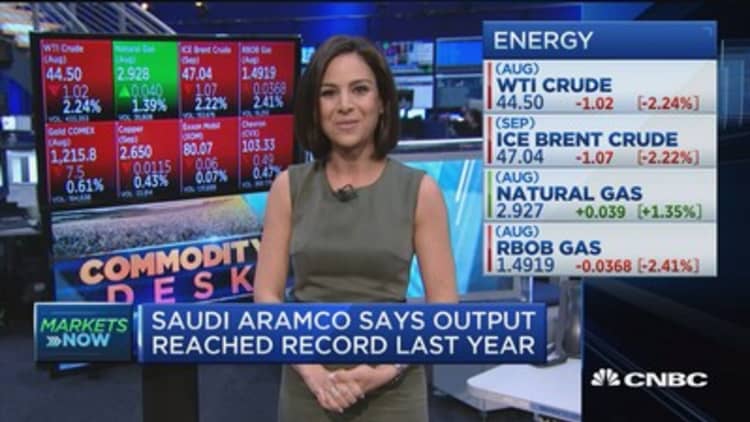

U.S. West Texas Intermediate (WTI) crude futures ended Friday's session down $1.29, or 2.8 percent, to $44.23 per barrel.

Brent crude futures, the international benchmark for oil prices, were trading down $1.47, or 3.1 percent, at $46.64 per barrel by 2:36 p.m. ET (1836 GMT).

After rising earlier in the week, U.S. crude ended the week down nearly 4 percent, a sixth weekly decline in the past seven.

"The stream of relentless supply continues," said Matt Smith, director of commodity research at Clipperdata.

He noted OPEC exports were 2 million barrels a day higher in June than in 2016, despite a May extension of a 1.8 million barrel a day production cut led by the Organization of the Petroleum Exporting Countries.

"We've seen exports last month from OPEC much stronger than they were in April and May, seemingly indifferent to the OPEC production cut deal," Smith said.

Reuters oil data showed OPEC production is now at the highest level this year.

Russia, which is cooperating with OPEC in a deal to stem production, said it was ready to consider revising parameters of the deal if needed. A group of oil-producing countries monitoring the deal will meet on July 24 in Russia, when they could recommend adjusting the pact.

The Wall Street Journal reported OPEC is considering imposing production caps on Libya and Nigeria. The two countries are exempt from the output cut deal and have both raised production significantly in recent months.

A second consecutive month of higher OPEC exports in June coincides with a rise in U.S. output.

U.S. drillers added seven oil rigs in the week to July 7, energy services company Baker Hughes announced on Friday. This brings the total count up to 763, the most since April 2015.

On Thursday, weekly U.S. government data showed that U.S. oil production rose 1 percent to 9.34 million barrels per day (bpd) after a drop the previous week due to maintenance work and storm shutdowns.

"It takes somewhat lower prices to slow down U.S. production," said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management.

Amidst rising U.S. production, the market largely ignored news from the U.S. Energy Information Administration (EIA) that U.S. crude inventories fell by 6.3 million barrels in the week to June 30 to 502.9 million barrels, the lowest since January.

U.S. bank Morgan Stanley said it expected WTI prices to remain below $50 until mid-2018.

— CNBC's Tom DiChristopher contributed to this story.