took a tumble in the first half of 2017, falling 14 percent in an oversupplied market, but one fund manager believes oil is reaching a turning point.

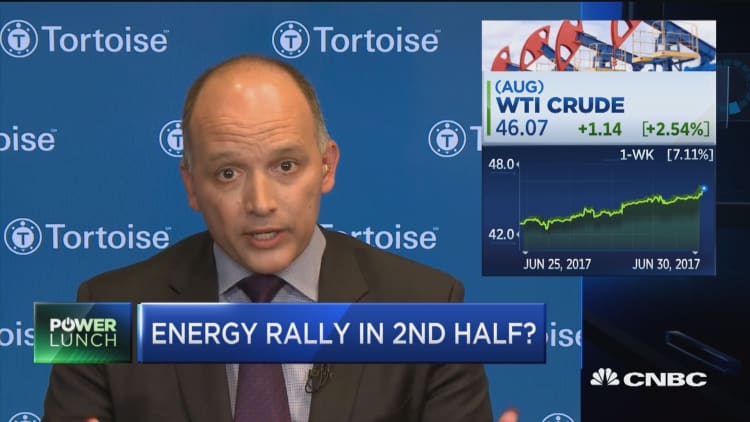

"The energy sector has been down but it is not out," Rob Thummel, managing director for Tortoise Capital Advisors, told CNBC's "Power Lunch" on Friday. "The fundamentals are set up for a second-half comeback."

Crude prices posted their worst first-half performance since 1998 as OPEC-led production cuts failed to achieve their goal: to significantly shrink huge oil stockpiles around the world. Thummel believes that is going to change in the back half of 2017.

"You are going to see crude oil inventories globally and domestically begin to decline month after month. That will support crude oil prices, boosting the entire sector," Thummel said.

Thummel also sees a lack of capital investment in U.S. production leading to an undersupply of crude oil, resulting in a rise in crude prices.

Oilfield services firm Baker Hughes reported on Friday that its weekly count of oil rigs operating in U.S. fields fell by two rigs, the first decline since January. Last week, U.S. crude output dropped 100,000 barrels per day to 9.3 million bpd, the steepest weekly fall since July 2016.

While the oil market rebalancing plays out, Thummel — whose firm has $16.3 billion of assets under management — thinks the midstream energy transportation and storage sector is an attractive investment.

"Put your money in energy infrastructure, it's a great place to be," Thummel said. "You get paid while you are waiting for higher oil prices."

"If you look at where [energy infrastructure] trades at historical levels, they look pretty cheap right now," Thummel added.