The GOP's tax plan contains a little-noticed tax hike on big earners that could add another $12,000 to their annual tax bill.

First highlighted in Politico, the provision in the new plan would claw back one of the benefits that wealthy taxpayers enjoy in the tax code. The plan calls for taxpayers to pay the lowest tax rate — 12 percent — on the first $45,000 of their income. But the plan would take that benefit away from those making $1 million or more.

So for someone making more than $1 million, instead of paying 12 percent on their first $45,000, they would pay the top rate of 39.6 percent. So they would end up paying an additional $12,420.

"This was a surprise until yesterday's release," said Joseph Perry, the tax and business services leader at Marcum, who advises many wealthy families. He added that the provision mirrors a similar feature in the corporate tax code, where firms that make more than $10 million or more pay a rate of 35 percent on their income.

While some in the media are calling the provision a "new hidden top tax-rate" of over 45 percent, it's really more like a built-in clawback on the break they would normally get on their first $45,000 of income. It's not as if the top rate would change from 39.6 percent.

Still, the proposed giveback would have raised about $5 billion in 2015 and will raise about $50 billion over the next decade, according to the plan.

And the provision is just the latest in a string of hidden tax hikes on big earners in the GOP bill.

The plan contains a "divorcee tax," which eliminates the deduction that divorcees who pay alimony receive. It also would limit the provision for "like-kind exchanges," which the wealthy often use for expensive art and collectibles.

That's not to mention the biggest tax hike for the wealthy — the elimination of state and local tax deductions. All the more reason why the GOP tax plan could face stiff opposition, especially from the wealthy.

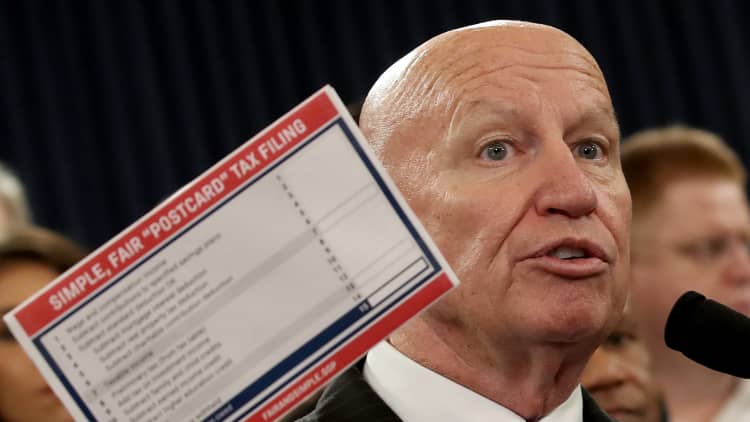

WATCH: What the tax bill means for the wealthy