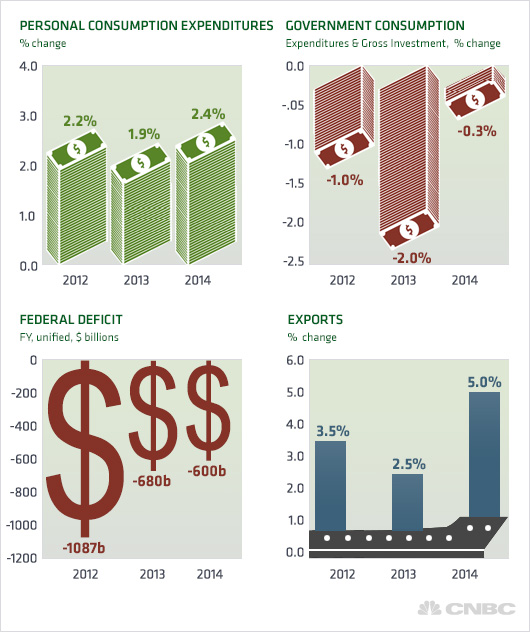

Our crystal ball is on the fritz, so we've rounded up some New Year's predictions from some reliable sources: a panel of more than 50 U.S. economists that participated in the National Association for Business Economics Outlook Survey released this month. Looking ahead, the consensus expect real GDP growth of 2.8 percent in 2014, despite quantitative easing in the first half of the year. On a positive note, they also believe the unemployment rate will fall to an average 7 percent. Here's a snapshot of the highlights.

It's a seller's market

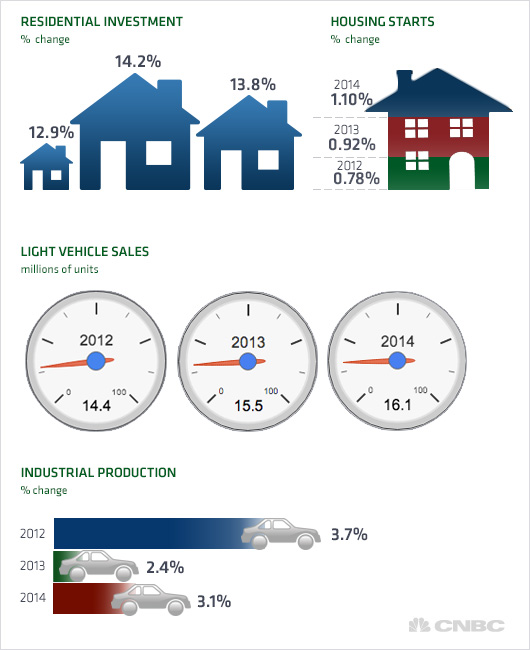

It's looking like another good year for businesses that make cars, houses and other goods. The ongoing recovery in housing and manufacturing is expected to pick up speed next year.

Inflation remains in check

Consumers can look forward to another year of relatively tame prices. Housing prices are expected to cool off a bit, and prices of other goods and services aren't expected to rise all that much.

The unemployment line shrinks

The job market will continue to show slow but steady improvement in 2014 as the jobless rate keeps ticking lower. That will help boost wages, according to the business economists.

Where the markets are going ...

All of which should help companies continue to post higher profits, driving stock prices higher. Our forecasters think interest rates are headed higher, though, which could send bond prices tumbling.

Bankers predict market swings

Here's where Wall Street bankers think the markets are headed: