Welcoming a baby in 2019? It's time for a financial overhaul.

More than a quarter of 30-somethings in a recent Ameriprise report listed "had a child" as a recent personal milestone that had a major impact on their finances. No wonder: For married couples with one child, expenses related to that child represent an estimated 26 percent of the family's annual budget, according to data from the U.S. Department of Agriculture.

It's a shift many families are anticipating.

Eight in 10 soon-to-be parents say they're financially prepared to have a child next year, a new survey from Haven Life found. Most say they have made improvements — such as increasing their emergency savings and sticking to a household budget — as part of their baby prep.

The insurer this month surveyed 500 adults, all of whom are planning on becoming parents or adding a child to their family next year.

Money moves families make to prepare for baby

| Financial steps | Percentage of expectant parents |

|---|---|

| Increased savings or emergency fund | 72% |

| Maintain and stick to a household budget | 66% |

| Review my health insurance benefits | 63% |

| Buy a safer car | 44% |

| Buy life insurance | 40% |

| Buy a home | 31% |

| Create a will | 30% |

| Increased my HSA or FSA contribution | 27% |

| None of these | 4% |

Source: SOURCE: Haven Life.

"Holistically, what the research tells me is millennials are taking paying for children very seriously," said Brittney Burgett, a spokeswoman for Haven Life.

It's notable, given that millennials have been notorious for putting off big moves such as buying a home and starting families due to financial instability, she said.

"That financial preparedness is probably why [these families] are having a child in 2019," Burgett said.

If you're hoping to grow your family next year, take these four key steps to prepare:

Wrangle your budget

"You've got to get organized," said certified financial planner Douglas Boneparth, who is preparing to welcome a second daughter in 2019. "With kids, there are so many financial variables that you cannot account for, that you can't really afford to be disorganized with the things that you can [account for]."

With that in mind, review your current (pre-baby) cash flow and budget. That can help you get a sense of how much wiggle room there already is to accommodate those to-be-determined baby expenses, as well as where you might spend smarter (such as reshopping your auto insurance or right-sizing your cellphone plan) or cut back on discretionary expenses to free up cash.

Keep in mind that your spending is likely to shift as a new parent, say, with fewer dinners out and concert tickets — which will help you cover new line items like diapers and baby food, said Boneparth, who is president of Bone Fide Wealth in New York.

Anticipate expenses

Speaking of those line items, start researching to get a sense of what both one-time expenses (such as baby gear, or giving birth) and ongoing bills (like diapers and formula) might cost you. The big one? Child care.

"There's a huge element of sticker shock that new parents get when they are pregnant, or beginning their [care] search," said Michelle McCready, deputy executive editor for Child Care Aware of America, an advocacy group.

In some parts of the country, the annual cost of child care is comparable to college tuition, she said — but with a much shorter runway to save.

It helps to get a sense of all your options early, along with bill-defraying strategies such as tax credits and tax-advantaged flexible spending accounts. Child Care Aware lists local resources by state, including agencies that can help parents find quality care.

Review workplace benefits

In the Haven Life survey, 79 percent of those expectant parents said they were aware of what their employer (and their partner's employer) offer by way of paternity or maternity leave benefits. That's potentially an expensive miss for the remaining 1 in 5.

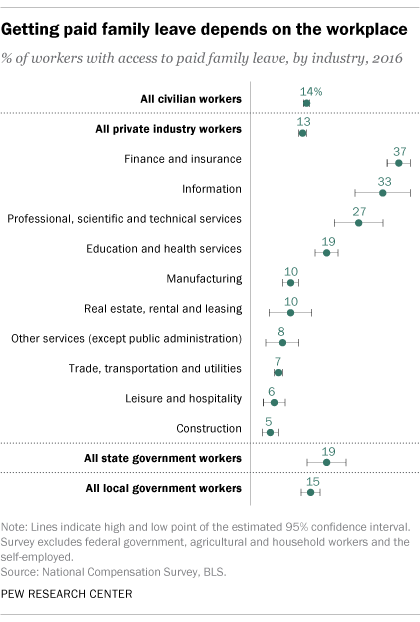

Just 14 percent of workers had access to paid family leave in 2016, according to a Pew Research Center analysis of Bureau of Labor Statistics data. Even those who do get paid leave may find that benefit isn't always generous in terms of duration, or percentage of salary covered.

"This could have a substantial impact on your financial life, especially for those who don't have cash savings to fill in the gap," Boneparth said.

Don't stop your inquiry with family leave. Child-care assistance, via benefits like dependent care flexible spending accounts, subsidized care and other programs, is an often-missed employer resource, said McCready.

In the Haven Life survey, just 27 percent of expectant parents had increased their contributions to health savings accounts or flexible spending accounts. That's also worth a second look ahead of added medical costs, said Burgett.

"That's something you absolutely are going to use," she said. "It's a low-hanging-fruit opportunity to take advantage of this tax-advantaged vehicle."

Bolster savings

It's a good sign that the move expectant parents were most apt to make is increasing their savings or emergency fund, said Burgett — 72 percent say they have done so.

Financial advisors usually suggest aiming to set aside three to six months' worth of expenses in a cash account, but even a few hundred dollars can help you avoid racking up credit card debt in the event of a financial setback.

Take any opportunity you can to build up savings before baby arrives, said McCready.

"There's so much involved in having kids," she said. "Unexpected things can happen."

Update key documents

Now's the time to make sure you have some basic estate planning documents and policies in place, including a will, power of attorney and life insurance, Boneparth said.

"If you've been dragging your feet on that, now there's virtually no excuse," he said. "This is pure sleep-well-at-night stuff.

"You can't mess around," he added. "There are literally human lives involved."

It's one of the potential misses the Haven Life survey turned up. While 79 percent of expectant parents say they have a financial plan in place if they or their partner were no longer around, only 30 percent have prepared a will, while 40 percent have bought life insurance.

Financial preparations shouldn't be your only concern in anticipating a worst-case scenario, Burgett said.

"You want to make sure you're having those important conversations about who a guardian would be," she said — that's another key reason to create a will.

More from Personal Finance

Using the bank your college recommended? Check for fees

Workers with company stock might have too much risk in their portfolio

Get a bigger check with these Social Security claiming strategies