Early bitcoin investor Tyler Winklevoss tweeted back at Bill Gates to explain how to bet against the cryptocurrency, after the Microsoft co-founder said he would short it if he could.

"Dear @BillGates there is an easy way to short bitcoin," Winklevoss said in a tweet Monday afternoon. "You can short #XBT, the @CBOE Bitcoin (USD) Futures contract, and put your money where your mouth is!"

A representative for Gates did not immediately respond to a CNBC request for comment.

Earlier on Monday, Gates said on CNBC's "Squawk Box" that "bitcoin and ICOs, I believe completely [they're some] of the crazier, speculative things."

"I agree I would short it if there was an easy way to do it," he said. Gates said someone once gave him some bitcoins for his birthday, but he sold it a few years later.

Bitcoin traded near $9,100 Tuesday morning. The cryptocurrency has lost more than half its value since soaring above $19,000 in December.

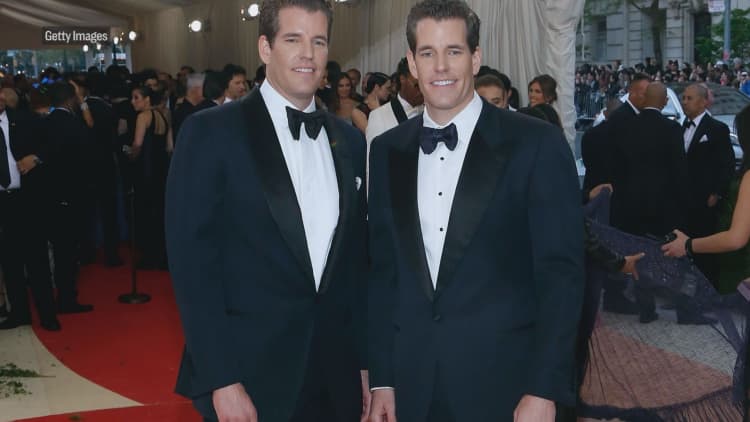

Winklevoss and his twin brother, Cameron, had $11 million in bitcoin at $120 a coin in April 2013. At Tuesday's price, their combined holding was worth about $834.17 million, assuming the twins haven't sold any. In 2015, the Winklevoss brothers founded digital asset exchange Gemini, whose bitcoin prices form the basis for the Cboe's bitcoin futures that launched in December.

Futures let traders bet on the price of an asset at a point months later. A trader who sells a futures contract in anticipation of a decline in bitcoin makes money if the price does drop. Trading to benefit from a decline is known as shorting.