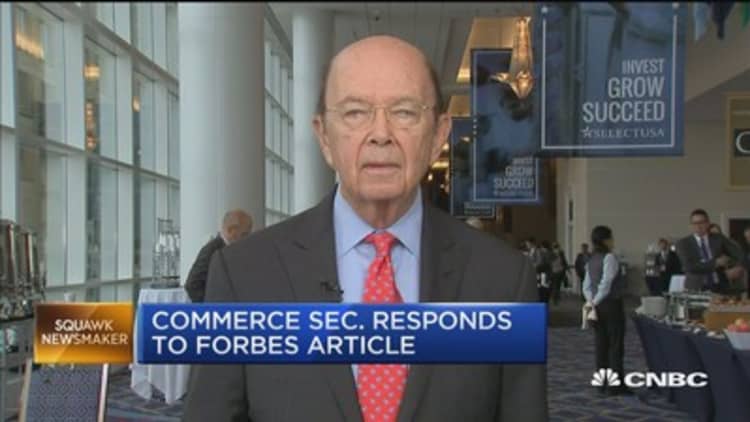

Facing scrutiny for his financial holdings, Commerce Secretary Wilbur Ross has revealed to CNBC that last year he shorted shares in two more companies than previously had been reported.

Ross disclosed to CNBC that in May 2017 he shorted the stock of both Air Lease and Ocwen Financial Corporation.

He maintains that he executed those trades for the same reason as three other recently revealed short sales that have raised eyebrows: to avoid any impression that his financial holdings represented a potential conflict of interest.

The secretary noted that he had been in the process of divesting himself of known stakes in the companies before becoming aware of the fact he had been awarded additional small stakes in each of the five firms as a benefit of having served on their boards of directors. Those shares were held in accounts he had been unaware of, he said.

Ross said the short sales in all five cases — which occurred during his tenure as Commerce secretary — zeroed out his stakes in the companies. After Ross covered the short positions, he realized no profit, or loss, on the trades, he said.

“These transactions are not profit-seeking short sales,” Ross told CNBC. “These shorts are technical ways of disposing the stocks.”

Ross said that all of the trades were approved, after he executed them, by the Commerce Department’s office of ethics and compliance.

Details of Ross’s three other short positions came to light last month, prompting renewed scrutiny over his financial holdings. Last fall, media reports revealed that Ross held, or had held, stakes in companies whose fortunes could be affected by U.S. trade policy decisions, with which Ross is intimately involved.

On June 18, an article in Forbes detailed how Ross shorted shares of liquid petroleum gas shipper Navigator Holdings and Sun Bancorp. A week later, Forbes reported details about a short position Ross took in The Greenbrier Companies.

Records show that Ross shorted Air Lease, Ocwen and Greenbrier in May 2017. He shorted Navigator and Sun Bancorp on Oct. 31.

Ross’s actions under fire

After news broke about his short sales, Ross was criticized by Sen. Ron Wyden, D-Ore., during an appearance before the Senate Finance Committee, where Ross was testifying about current and proposed tariff actions.

Wyden said controversy over Ross’s financial dealings could weaken efforts to improve America's trade position.

Richard Painter, who served as chief White House ethics lawyer under President George W. Bush, told CNBC: “I never heard of someone using short positions to divest.”

“I helped in hundreds of transactions for employees entering government,” noted Painter, who is now a Democratic candidate for senator in Minnesota. “This is not an acceptable situation,”

But Jacob Frenkel, a former federal criminal prosecutor who had handled corruption and financial crimes, said that Ross’s transactions highlight “the challenge presented to uber-sophisticated investors with large portfolios who enter government service."

“While it may not look good on its face, this clearly is an example of how someone is trying to do the right thing rather than cover up that we so often see,” said Frenkel, now a partner at the firm Dickson Wright.

A legendary investor who made his fortune in distressed assets, Ross came into office in early 2017 with a long, complicated list of financial holdings.

According to a financial disclosure report filed last year, Ross and his wife, Hilary Geary, held combined disclosed portfolios consisting of more than 483 assets, income and retirement accounts. The value of those assets was estimated to be between around $51,029,060 to $523,981,070.

After President Donald Trump nominated him to be Commerce secretary, Ross announced that he planned divestitures of at least 80 assets and investment funds.

In recent weeks, Ross has said that his short sales were done to accomplish that goal. He explained that in each case, he learned after he began divesting in companies that he had been awarded additional shares in the firms as compensation for serving as a director.

“When I found out I had these investments my first reaction was to short them since they were not in my physical possession, and I had to wait until I received them from the transfer agent to dispose of the shares,” Ross said.

“My intent was to be economically neutral to ensure no perceived conflict,” Ross said.

WATCH: The full interview with Commerce Sec. Wilbur Ross