Boeing shares fell Monday as the company is expected to soon decide whether to further cut or suspend production of the 737 Max as the timeline for the beleaguered plane's return to service slips into 2020.

The company has repeatedly warned investors that it could cut output of the planes again or suspend its production line if the flight ban drags on longer than it expected. Boeing CEO Dennis Muilenburg has said that suspending output altogether could be "more efficient" than lowering output again.

"We continue to work closely with the FAA and global regulators towards certification and the safe return to service of the Max," Boeing said in a statement Sunday night to CNBC. "We will continue to assess production decisions based on the timing and conditions of return to service, which will be based on regulatory approvals and may vary by jurisdiction."

Boeing, whose board is holding a regularly scheduled meeting in Chicago, cut 737 Max production in April by 20% from 52 to 42 aircraft a month in the wake of a second fatal crash of the best-selling plane within five months. Regulators around the world responded to those crashes by grounding the aircraft.

The decision could come as early as Monday, The Wall Street Journal reported Sunday.

Boeing acknowledged last week that regulators aren't likely to recertify the planes by the end of the year, as the Chicago-based manufacturer had previously forecast. A further cut or a suspension of production would further weigh on Boeing, which is facing a rising bill from the Max's grounding. The company took a nearly $5 billion after-tax charge in the second quarter to compensate airlines hit by the flight ban.

A temporary shutdown of production would ripple throughout Boeing's supply chain to companies that make parts for the 737 Max.

Boeing shares lost 4.3% to close at $327, shaving nearly 100 points off the Dow Jones Industrial Average. Spirit AeroSystems, which makes 737 Max fuselages fell 1.6%, while General Electric, the engine-maker for the plane along with its French partner Safran, dropped 1.5%.

The flight ban has drained cash from Boeing since it has been unable to deliver the planes to customers. Customers like airlines pay the bulk of the plane's price on deliveries. New orders have nearly all but dried up this year.

Boeing's shifted outlook came after the Federal Aviation Administration publicly admonished Boeing on Thursday over concerns that the company "continues to pursue a return-to-service schedule that is not realistic due to delays that have accumulated for a variety of reasons."

"More concerning, the Administrator wants to directly address the perception that some of Boeing's public statements have been designed to force FAA into taking quicker action," the agency said in an email to lawmakers.

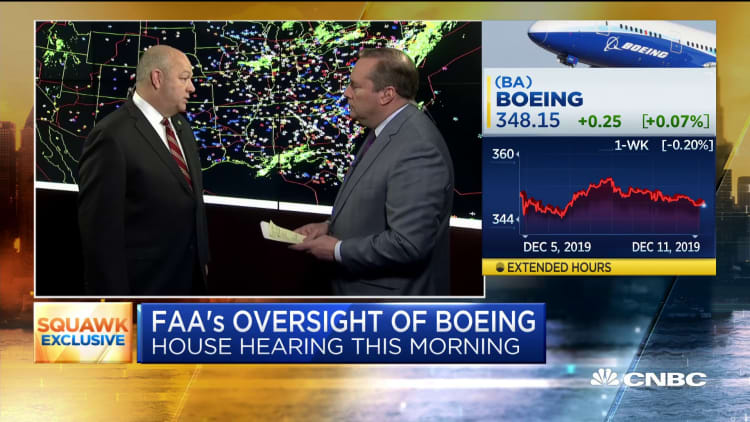

FAA chief Steve Dickson told CNBC on Wednesday that the regulator won't likely clear the 737 Max's return until some time in 2020.

The prolonged grounding has forced Boeing to consider scaling back a planned ramp-up in production next year, sources have told CNBC. Boeing shares are down about 20% since the second crash in March but are up 6% this year.

A Boeing spokesman declined to comment on the timeline but said it is working "closely with the FAA and global regulators towards certification and the safe return to service of the Max. We will continue to assess production decisions based on the timing and conditions of return to service, which will be based on regulatory approvals and may vary by jurisdiction."

The timeline for the 737 Max's return has slipped repeatedly, creating uncertainty for airlines such as American, which last week pulled the planes out of its schedule until early April, meaning it expects the grounding to last more than a year. The plane's grounding has cost airlines, including American, Southwest, and United, hundreds of millions of dollars in revenue.