After outpacing the broader markets for most of the year, the consumer trade is starting to show some cracks.

The Consumer Staples ETF XLY is up more than 22% in 2019, but as of Friday's close, more than half of the stocks in the sector found themselves in correction territory. According to Cornerstone Macro Head of Technical Analysis Carter Worth, more pain is on the way for this sector.

"Even as [the XLY Consumer Discretionary ETF] is appreciating, it is underperforming, and basically at or near 52-week lows in terms of opportunity cost, or alpha," Worth said Friday on CNBC's "Options Action."

Those 52-week lows against the S&P 500 also coincide with a fairly stark break in trend from a technical perspective. The XLY hasn't made new highs since July, even as the broader markets continue to set record. Now that the ETF has plunged through a trend line on a relative basis, Worth thinks it will fall even farther.

"We have consistently come to life off this line, and now we have broken below that relative line, and I think what is going to happen, ultimately, is that we break on an absolute basis as well," said Worth.

A break in trend isn't the only worrying sign Worth points to when it comes to the health of the sector. Since July, the XLY has been making lower highs and higher lows, and as the chart begins to consolidate into a tight range, Worth says the eventual resolution might not be kind to investors.

"[There is] a lot of tension here, and my hunch is this is going to get resolved that way," said Worth, drawing a line downward, "instead of up."

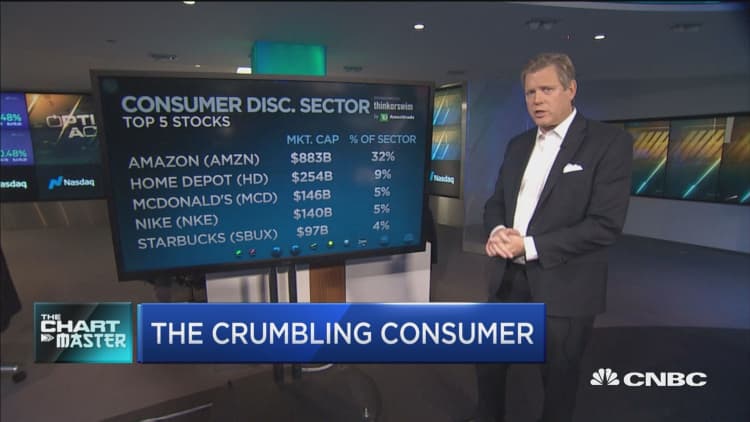

The XLY, whose largest holding is Amazon, was trading slightly lower on Monday.