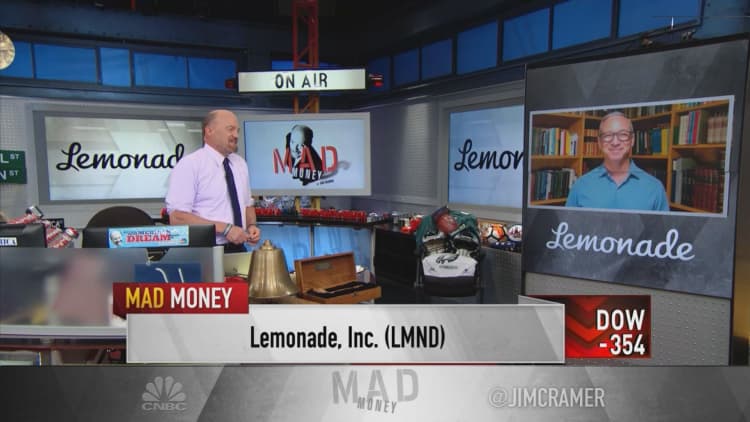

Lemonade CEO Daniel Schreiber told CNBC on Thursday the insurance company's goal is to build trust with its customers, contending the lack of it is an expensive problem for the industry.

"Perhaps the costliest problem in insurance is distrust. People don't like their insurance companies," he told CNBC's Jim Cramer in a "Mad Money" interview. "They don't trust their insurance companies. It doesn't matter how much money the insurance company has, people don't believe they're going to pay them when the day comes."

Schreiber said Lemonade, which went public earlier this month, has sought out to build trust with its customers in a few ways. On one hand, he said the provider of renters, homeowners and pet insurance has used technology to build a quick, enjoyable user experience.

"At Lemonade you buy an insurance policy in 90 seconds. You get paid in as little as three seconds," he said. "That crushes costs and delights consumers but there was a deeper problem to resolve."

To help solve the conflict of interest people may believe is at hand, Schreiber said Lemonade established itself as a public benefit corporation, with some of the firm's underwriting profits going to nonprofits.

Lemonade, launched in 2016, also operates under a flat-fee model, according to Schreiber. It's a business strategy employed by other tech companies, but it's not common in the insurance industry, he said.

"You pay me a buck, I tell you in advance that I'm going to keep 25 cents on the dollar and if there's money left over after paying claims and buying the insurance, I'm going to give it to to a charity of your choosing," he said. "This isn't just 'do good' stuff. It's about aligning interests so I don't make money by denying your claims and you'll think twice before embellishing your claims."

Shares of Lemonade closed Thursday's session at $82.16 each. The stock hit a high of $96.51 on July 6, a few days after its IPO. It went into its public debut priced at $29 per share.

Schreiber said Lemonade intends to continue spending heavily to grow its market share. It posted a net loss of $108.5 million in the year ending Dec. 31, 2019, according to a filing with the Securities and Exchange Commission. It had total revenues of $67.3 in that same period — up from $22.5 in the prior year.

"We do want to make heavy investments right now," he said. "The prize is so big. ... This is market is as close to unlimited as possible and hopefully every dollar we're investing now will be returned to us several fold in the years and decades to come."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com